Navigating Tariff Turbulence: Optimize Your…

The introduction of the PSD legislation opened many doors for different types of payment systems. This article covers the advancement and possibilities of this technology in today’s and future’s world.

The introduction of the PSD legislation opened many doors for different types of payment systems. This article covers the advancement and possibilities of this technology in today’s and future’s world.

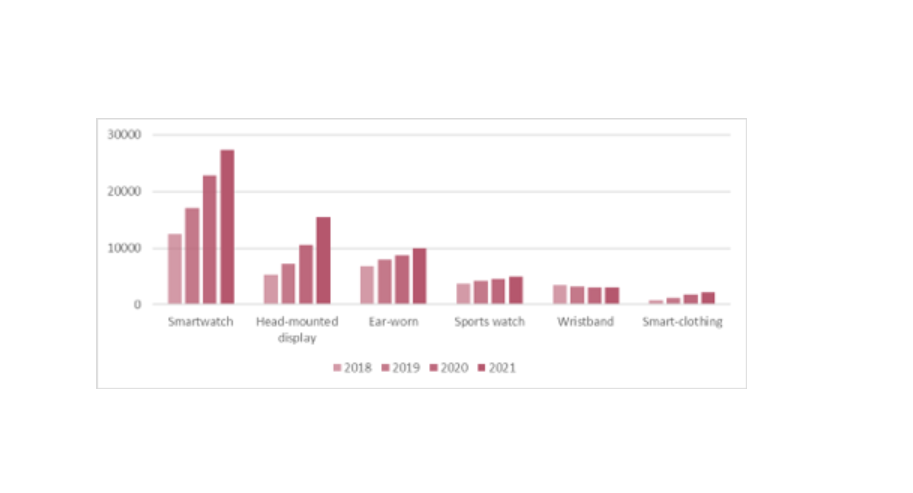

In 2013 Google X launched, audaciously, the first wearable named Google Glass. Google Glass displayed information in a smartphone-like, hands-free format and its users communicated with the Internet through natural language enabled voice commands. Eventually, Google Glass was nothing more than a short-lived hype that put wearables (temporarily) in the fad technologies. However, a few years later, more and more wearables have been produced in different forms; from watches to T-shirts, band-aids, rings, lenses or even shoe soles. As expected, wearable devices have continued to gain traction in 2019, a trend which is likely to continue in 2020. According to a recent Gartner study, global-end user spending on wearable devices will total $52Bn in 2020, and Mastercard counted over 175 million of Europeans to be using wearables devices for contactless payments. Overall, smartwatches and head-mounted displays are capturing most of the wearable devices market share, making up 42% and 18% respectively. Whereas smartwatches are well known devices, head-mounted displays are less so and refer to Virtual Reality tools such as the Oculus rift.

Figure 1 - Wearables end-user spending forecast (in millions of Dollars), study by Gartner 2019

Wristbands are being increasingly replaced by smartwatches, indicating that wristbands do no longer offer any significant benefit over the purchase of a smartwatch. Whereas wristbands were previously worn complementary to a classical watch, and preferred because of their lower entry price and often superior battery life, smartwatches are now considered a worthy substitute to classical watches. The same replacement effect is happening to sport watches, albeit at a slower pace.

Wearable devices have recently made their introduction into the payments landscape, opening up new and more practical ways for customers to conduct their payments. The wearable payment transactions volume is growing at staggering rate and is projected to reach $500Bn by the end of 2020 [1] . The most well-known examples of these services include Apple Pay and Google Pay. However, the landscape is effectively widening, new players and new NFC (Near Field Communication) applications are impacting the entire value chain.

In the following section, we will demonstrate that wearables as a technology face many different challenges (Data security, regulatory pressure, PSD2, …), but, if executed correctly, have an enormous value for companies to grow their customer base and data pool.

[1] Infosys

The devices that are being used today are dedicated to either payments or wearable functionalities. Most common examples of this are the smartwatches, bracelets, rings, and key fobs. For the three latter devices, the focus of the device is truly aimed at payments or identification means. In the coming years, wearable token service providers will allow any device whether it is digital or not, to serve as a payment device.

An example of one of these wearable service token providers is Tappy, which has partnered up with players such as Mastercard, Visa, and Barclays for transaction processing. As is already frequently done today, tokenization makes it possible to digitize your payment cards, and upload them to your phone. What Tappy does, is integrate very simple hardware modifications into your wearables, which make it possible to turn almost any device into a wearable (e.g. watches and rings). All this without the need for any battery or a smart device. One of their partners, Timex, has already started implementing their services into their timepieces.

To build upon this, Zwipe has also partnered up with Tappy to enhance this functionality with biometric authentication solutions. Biometric authentication relies on unique biological characteristics of an individual to verify one’s identity. There exist many different types of biometric authentication, such as finger scans, facial recognition, retina and voice identification. Although the first two examples of authentication are the most popular, thanks to PSD2 it will also be possible to authenticate with your heart rate rhythm or even the angle at which the device is held.

Zwipe’s main product consists of a payment card that has a built-in fingerprint scanner to ensure secure and easy payments. Through this functionality, there is no longer a need to enter a PIN code for contactless payments that pass a certain threshold (equal to € 25 in Belgium). Together with Tappy, they have moved beyond the cards and now started implementing fingerprint sensors in wearable devices as well. Zwipe developed a robust biometric inlay platform that can be easily integrated in places such as a watch-strap or wristband. Merging these technologies makes it possible to effectuate secure payments with any device.

Healthcare monitoring

The healthcare industry is one of the largest markets for the wearables industry and provides a staggering range of possibilities. Smartwatches are able to track your heart rate and activity levels, wristbands can track your stress levels, skin patches are capable of analyzing sweat samples, and ingestible are capable to analyze your digestive system for diagnostic and preventive purposes.

In the US and UK, John Hancock, through Vitality, has already started shifting to use wearables in its insurance policies. Through the support of a mobile application, users are guided to improve their lifestyle (by walking, running, or going to the gym) to reduce their insurance premiums.

Location based tracking

Whereas location tracking is already done through smartphone usage, it is expected that this functionality will increasingly be used in the insurance industry. Location based tracking can be used to improve premium calculation, and also in the claim filing process to give a time and location proof.

Allianz has rolled-out an Allianz Bonus Drive App that analyzes your driving behavior to determine your car insurance premium. Information that is being used includes where you drive, when you are out on the road, and what your driving style is. An addition to these existing functionalities could be data from your smartwatch which indicates how stressed you are or whether you suffer from any fatigue. When applied properly and with the usage of positive reinforcement, this information can be used to assign a more suitable insurance premium to clients. However, this could lead to the same controversy some users of telematics’ black box have, which is a constant feeling of being tracked and observed.

Collision impact

Building on the previous car insurance example, wearables can also be used to measure abrupt changes in acceleration. This means your insurance company may know instantly if you are in a car accident, and could put you through with emergency services if needed. Dropping your phone may also be registered in the future, and trigger an automated email suggesting screen repair and potential insurance policies you may have right to. Using technology expands the possibilities and playing field of an insurance product to boost their customer experience.

Wearables do not only give access to novel and continuous streams of data, but also generate several security concerns. With regards to wearable technology, we identify three external threats. First, Bluetooth theft can happen when many devices, including the wearable, are connected to one another. This could allow sensitive data to be stolen. Second is the potential for signal interceptor issues, which means that potentially unsecured and non-encrypted data can be captured through signal interceptors. This reaffirms the need for strict standards, and forces companies who have no previous experience with Bluetooth to develop new capabilities. Third and last is the potential for a virus attack on a wearable device.

Whereas these attacks are external, other risks can also arise from the user-side. Especially in the insurance industry, there is a big risk for abuse. Wristbands can be worn by other users, other than the end user. Systems can be built to mimic pulse and heart rate. Collision impacts can be easily simulated and location information through GPS signals can also be disturbed with little difficulty. Insurance companies who want to move to the field of wearables need to be very attentive to fraud potentials and estimate what new risks they will be facing.

From a customer experience point of view, wearables offer many opportunities as well as challenges. These devices are not just a new channel through which companies can communicate (e.g. through push notifications), but they also generate an influx of previously unknown and largely unstructured data.

In general, there are three non-exclusive ways in which wearables can be used by businesses. First, they can act solely as a communication channel. Receiving emails, text messages, and promotional content. Second, the devices can be used for companies to expand their product and service offering. This can be clearly seen in the payments industry where banks use a wide range of wearables to improve the customer experience and deliver more engaging moments. Third, the wearable can be used as a source of data which can be leveraged to enhance existing products and services. From an insurance point of view, this means leveraging new data to optimize price setting and risk management.

As a fifth and final trend of wearables in 2020, the identity and access management feature can possibly end the existence of badges, tickets, and lanyards. Being able to prove your identity with your watch or a wristband is expected to become a standard functionality.

A use case could be walking into a museum to buy tickets. Paying for your tickets with your smartwatch which is biometrically secured with your fingerprint. Automatically, the entrance tickets will be uploaded to your watch and smartphone. With a simple tap from your smartphone to a sensor at the gates, you will be able to prove the purchase of your tickets without any paper trail.

One can imagine even further scenarios whereby the use of wearables is fully excluded. This can include the temporary tokenization of biometric information. Imagine walking into swimming or fitness club, and you do not wish to carry around your phone or a badge to enter each space, as water and sweat might damage your phone or you could lose your belongings. When checking into the center, use your phone to send a tokenized version of your fingerprint to the fitness systems. There, this token will be temporarily saved on their systems. Each time you wish to enter a room, you use your finger on a secured on-premise fingerprint scanner that compares their existing data database of tokenized fingerprints to the newly submitted token. In case there is a match, you are granted access. This works in the same way as filling in password, or a PIN code.

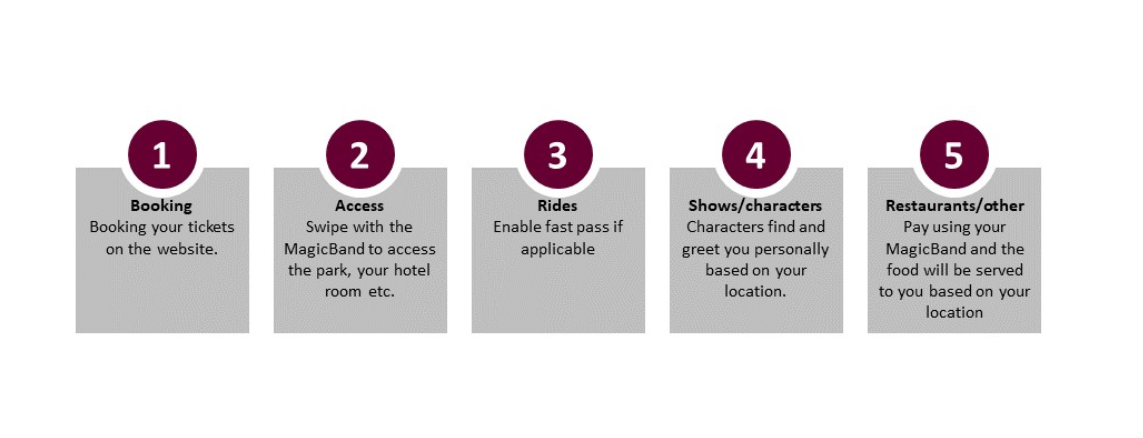

Figure 2 - Disney World Customer Experience

An excellent real-life example of this experience, can be found at Disney world with their MagicBand [5]. MagicBands are how Disney revolutionized their ticket system, turnstile and FastPass system, hotel key system, and hotel room charging system. MagicBands are waterproof, wearable tickets/keys/credit cards for resort guests that function over RFID, have a two-year battery, and work almost everywhere on park property. Here is a testimony of a Disney World customer on the MagicBand: “Coming into the Magic Kingdom? Tap your MagicBand to the turnstile and press your fingerprint to verify your identity. Going back into your room? Tap your MagicBand to unlock your door. Paying for your oh-so-delicious Mickey Bar? Tap your MagicBand to the contactless payments pad, type in your PIN, and be on your way. No fussing with PINs and fingerprints on my phone, no messing with figuring out where the NFC tag on this damn thing. It. Just. Works. 100% of the time.”

[5] https://www.androidcentral.com/i-have-glimpsed-future-wearable-payments-...

As mentioned above, the combination of PSD1&2 with NFC created a wide range of applications on many fields like insurance, payments, customer journey etc. However, it doesn’t stop there and the future of wearables seems to entail even more Sci-fi applications. For example, IMEC is developing a technology that captures and analyses data of your digestive system for diagnostic and preventive uses. This microscopic equipment is called an ingestible and is to be swallowed inside the human body. Another example can be found at Elon Musk’s company NeuraLink and the tech company Next-Mind [8]. Both of these companies develop devices that can send commands just through neurological impulses/signals. The scope of application ranges from video gaming (with Virtual Reality technology) to controlling any hardware allowing, for example, people with disabilities to gain more independence. Coming back to our introduction with the Google Glass phenomenon in 2013, we see that in just a few years, the wearables industry has taken it to the next level and it is not going to stop.

We at Sia Partners, a global management consulting firm, believe that devices such as wearables play a key role in banking and insurance (e.g. data analytics and monetization). As part of our consulting 4.0 strategy, Sia Partners has been creating expertise in data science together with valuable knowledge on PSD and GDPR regulation. Regulation can be seen as restrictive, but in terms of data security and consent of customers, regulation such as GDPR can work hand-in-hand with wearables technology and monitoring of behavior. In combination with project management experience, we can deliver superior value and focus on tangible results for our clients.

At Sia Partners, we believe many of our clients can benefit from implementing wearables in a thoughtful way. Companies can already start putting wearables to work for them as the technology is both mature and versatile. As part of our consulting 4.0 strategy, our data science and technology focus allow us to support our clients in identifying the right opportunities for their businesses. Our strong sectorial expertise and hands-on approach means we assist with issues ranging from opportunity identification and prototyping to companywide implementation and training.

ANTHONY WOLF

Associate Partner

+ 32 477 33 77 37

anthony.wolf@sia-partners.com

VIKTOR SMITS

Consultant

+ 32 483 50 88 90

viktor.smits@sia-partners.com

DORIAN VANHAM

Consultant

+ 32 478 69 10 00

dorian.vanham@sia-partners.com

Copyright © 2019 Sia Partners. Any use of this material without specific permission of Sia Partners is strictly prohibited.