Opportunities for waste management from solar and…

Recent spikes in energy prices have reminded us how Gas is still at the heart of the UK energy system. Gas networks will continue to play a key role for decades to come and their transformation, not their disruptive replacement by electricity, is essential to achieve Net Zero.

Wholesale gas prices have set record highs in recent weeks. High prices in both forward and spot markets, as well as record levels of volatility, have been observed in Great Britain (GB), the European Union (EU) and worldwide. Global demand for gas is high as countries bounce back from Covid-19 lockdowns. Supply chains are being squeezed across industries due to difficulties in shipping and sourcing parts and labour.

High demand means that Europe is now competing with Asia and Latin America for LNG cargoes. Asian buyers are prepared to pay higher prices for LNG shipments, thus US and Qatar exports are skipping Europe’s LNG terminals. Russia, Europe’s largest gas supplier, has been accused of curtailing gas flows to Europe. In recent weeks, Russian state monopoly Gazprom has delivered its long-term contracted volumes but has offered lower volumes for sale in prompt markets. Gas storage levels across Europe were low in early autumn, at only 72% against usually 94% full at the same time last year. Markets are increasingly skittish in the face of a winter with high prices and lower than normal storage reserves.

In 2019 and even in 2020, at the heart of the COVID-19 pandemic, Gas represented 51% of the final energy consumption (excluding the transport sector) in the UK, where the main uses are heating, industrial processes and power generation [1]. Gas remains the UK power system’s marginal fuel: in Q1 2021, gas made up 39% of the electricity supply mix. Rising gas prices, along with the partial outage of an electricity interconnector (Interconnexion France-Angleterre, between France and GB), over a period of low wind generation, have pushed power prices to record levels in autumn 2021. Loss of capacity on electricity interconnectors and periods of low wind generation mean that GB must make up the shortfall with other sources of generation, increasing the dependence on gas.

Current high power prices in GB have already led to dramatic market impacts. All firms are impacted by rising energy costs, which could prompt curtailed production, leading to shortages of materials for firms and consumers. Large transmission-connected electricity customers, including steelworks and fertilizer plants, have already curtailed production due to rising power prices. Soaring wholesale prices have seen costs rise to unsustainable levels for some suppliers: a total of 23 suppliers have collapsed between August and November 2021.

Consumers will pay for supplier failures. Under the Supplier of Last Resort (SoLR) process, the customers of failed suppliers are transferred to a different supplier with their power supply uninterrupted. The suppliers who take on the customers can apply to recover costs, which are not yet known but will be high. Ofgem recently announced a 12% increase in the standard variable tariff price cap and plans to consult on major changes to the price cap. Some suppliers argue that the price cap has exacerbated the crisis, preventing suppliers from passing on wholesale costs quickly. Beyond wholesale power prices, the rising cost of gas and power has seen the cost of doing business in the energy market grow dramatically [2].

When a household cannot afford to adequately heat their home, they are considered to be in “fuel poverty”. According to the latest estimates, approximately 13% of households in England are classed as fuel poor. The slightest changes in gas prices will affect the fuel poor households in a disproportionate way. Charities estimate that the combined effects of the Covid-19 pandemic and the energy crisis will add an estimated 488,000 people into fuel poverty. It is highly likely that, as a consequence of being unable to pay, many more vulnerable consumers will be put on pre-payment meters, which paradoxically are usually one of the most expensive ways to pay for energy.

On our transition to Net Zero, it is critical to keep fuel poverty on the top of the agenda in order to make sure that the path to decarbonisation is fair and affordable to all. Gas and Electricity networks are addressing the fuel poverty problem together with industry stakeholders and considering solutions in their business plans for RIIO-ED2 and RIIO-GD2 periods.

Natural Gas is a fossil fuel and thus its combustion creates emissions of CO2 and other Greenhouse Gases. The roadmap to Net Zero considers that natural gas will be gradually phased out. Across the main contributing sectors (energy, heating, transportation, agricultural and industrial processes), the decarbonisation of the economy may involve the full phase-out of the gas infrastructure or, otherwise, the decarbonisation of gas. The full phase-out of the gas infrastructure creates fundamental risks:

A diversified energy mix, where there is no dependency on only one energy vector, is key to achieving Net Zero within the required timescales and in a cost-efficient manner for consumers. It implies a gradual transformation and upgrade of the current gas infrastructure, not the full replacement with a new one.

The energy industry is exploring closely the route of decarbonisation of gas and it is predicted that green gas represents a substantial role in the future UK energy system. The transformation of industrial processes, the rollout of renewable energy sources and energy efficiency measures require significant technological innovation, policy and regulatory changes, financial investments and, often, lengthy construction projects. The Future Energy Scenarios that predict the fastest transition into a low-carbon energy system consider the use of natural gas for electricity generation and heating until the 2040s decade, whilst the UK Government predicts a stable use of gas and solid fuels until then [3].

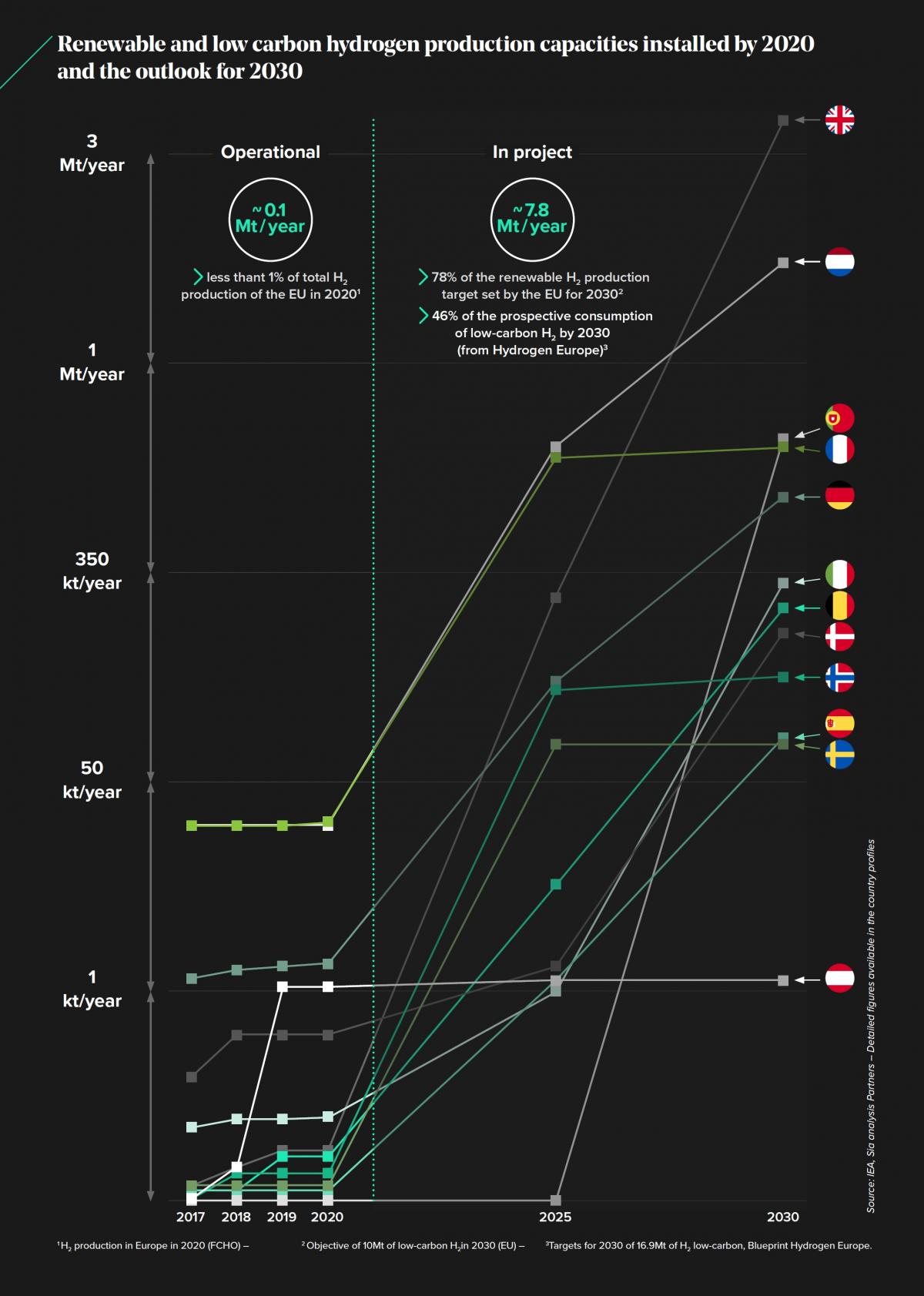

There is currently intensive research for low carbon replacements of natural gas. Along with biomethane and other green gases, hydrogen is the most consensual solution. Both UK Government’s Net Zero Strategy and EU’s Green Deal (and Hydrogen Strategy) consider hydrogen as a key piece in the future decarbonised energy system puzzle. The projected yearly production of 7.8Mt of green hydrogen is a strong sign that there will be a wide market for hydrogen in the UK and EU (Fig 1). Together with the industry, the UK Government is planning for 5GW of low-carbon hydrogen production capacity by 2030 and pioneering hydrogen heating trials. These are signs that there will be a growing hydrogen market in Europe.

Low carbon hydrogen production capacities (source: Sia Partners).

In the 2030s and 2040s, it is anticipated that hydrogen will play a key role in the energy transition. Excess renewable electricity can be converted to green hydrogen via electrolysis, bringing multiple benefits: firstly, it provides long term flexibility and an alternative to long term energy storage; secondly, it enables the decarbonisation of transportation and heating, either by direct hydrogen consumption or production of biofuels; thirdly, it reduces the need for curtailment of renewable energy in remote areas of the grids and provides an alternative to electrical networks that will be highly congested due to increased electrical demand. In 2050, hydrogen and other green gases will represent a major stake in the final energy demand in the UK, across all sectors. The hydrogen value chain is under development. Sia Partners’ European Observatory for Renewable and Low Carbon Hydrogen concludes that carbon-free hydrogen is the energy vector that promotes the integration of renewable energy and makes the « hard to abate » sectors greener and builds a clean and resilient economy.

The rollout of hydrogen as the main fuel source will require significant developments. The production of hydrogen is costly (most hydrogen is still produced via fossil fuels); given the current carbon content in the European electricity production, the hydrogen that is currently produced cannot be considered low carbon in most countries analysed by the Observatory. Hydrogen demand is still residual, mostly for some industrial and agricultural processes. There will be a need to scale up transport and storage infrastructure to facilitate the compression to higher pressures and the transport over long distances (such as in the current process for natural gas).

With regards to transport and distribution, GB Gas networks have been evaluating the capability of their infrastructure to operate with hydrogen (e.g. ENA’s Gas Goes Green), including the concepts of hydrogen blending and point-of-use separation (deblending). It concluded that the UK National Transmission System (NTS) can be used in a hybrid way to transport hydrogen and green gas. All four opportunities identified by IEA to promote the widespread use of hydrogen are underpinned by the use of current gas infrastructure, namely ports and pipelines [4]. To continue ensuring the security of supply and avoid disruption near consumers, it is of utmost importance to enable a smooth transition onto a low carbon energy system. Gas will continue to be pivotal in the UK energy system in the 2030s and 2040s, while the hydrogen value chain develops. Gas networks will need to gradually upgrade their infrastructure to transport hydrogen and green gases.

National Grid Gas plc (“NGG”) owns and operates the regulated gas National Transmission System (“NTS”), as well as National Grid Metering, which is the management entity for 8m gas meters in the UK. Earlier this year, National Grid plc announced the strategic pivoting of the Group’s activities towards electricity and the sale of the National Grid Group’s majority stake in NGG.

NGG’s revenues (£1.12bn in FY 2020/21) are underpinned by a stable regulatory framework (Ofgem’s RIIO-GT2) that includes incentives for outperformance and provides a high level of certainty for the period 2021-2025. The large asset base (Regulatory Asset Value of £6.3bn) provides the company with dividend and debt capacity.

As mentioned, Gas will continue playing a key role in the UK energy system and Gas networks will be pivotal in the transition to a Net Zero system. The UK’s Net Zero agenda sets a supportive framework for long-term growth and investment in Gas, by establishing hydrogen as a cornerstone for future storage, heating and transport systems. NGG is well-positioned to capture growth opportunities: NGG plans for innovation and enablement of a hybrid transmission network that allows for the introduction of hydrogen and biomethane in the Gas Transmission and Distribution networks. Also, there will be growth opportunities in current and adjacent markets for Metering, namely in the multi-fuel segment and data management services.

NGG represents an attractive investment given its high operational and financial performance and its current and future key roles in the UK energy system. Potential synergies with interested companies in the sector include the development of solutions in the compression, transport and commercialisation of hydrogen and biomethane, as well as the utilisation of gas metering data to improve housing quality and fight fuel poverty underpinning a high social responsibility. The NTS is uniquely positioned to connect to the North Sea Hub, which will likely become a principal source of green hydrogen.

The capability of the UK NTS to transport, import and export hydrogen and green gases in a decarbonised energy system will be critical for NGG to be at the heart of the future Net Zero system in 2050. Until the maturity and connection of long-term energy storage technologies, the decarbonisation of the UK energy system will be underpinned by the flexibility of gas-fired power plants to ensure the security of electricity supply and by the gradual replacement of natural gas in heating and industrial processes.