Fortune 100 response to DE&I pressures

In light of the ECB's priorities for 2023-2025, we outline a framework to comply with the ECB guidance

The ECB recently published its supervisory priorities for 2023-2025. Priorities are identified based on an assessment of the risk and vulnerabilities faced by supervised banks.

Banks are expected to renew efforts to strengthen their risk appetite framework (“RAF”) within their organizations: They can leverage several initiatives to drive their risk management capabilities forward.

Banks should adhere to supervisory expectations to comply with the ECB guidance by:

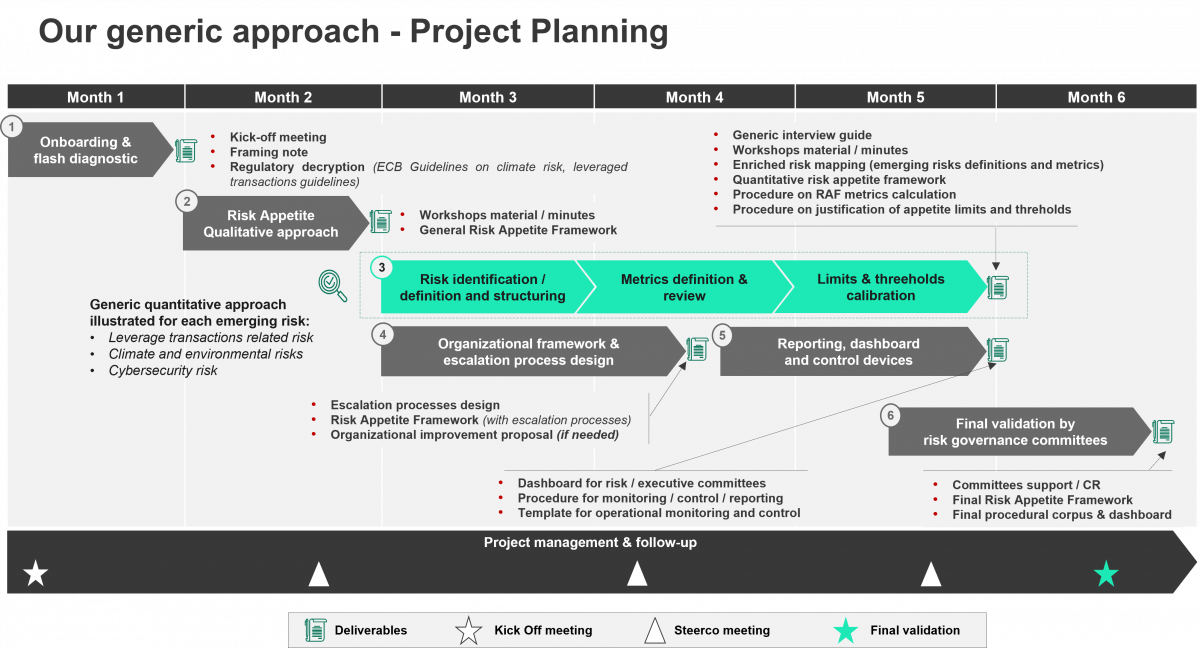

Sia Partners has developed several capabilities and expertise to assist you in your transformation.

You should leverage the following initiatives to drive your risk management capabilities forward:

Establish a robust Risk appetite Framework

Effectively implement and integrate the RAF with relevant business processes

Incorporate RAF into decision-making, strategy execution and business planning

Articulate risk appetite through metrics and limits

1. Structuration and Decomposition of Risks

2. Risk Appetite Metrics

3. Calibration of Limits and Thresholds

4. Process of Review & Reporting for Risk Governance