Agentic AI: Are you ready?

The Payment Service Directive (PSD3), Payment Service Regulation (PSR), and Financial Data Access Regulation (FiDA) are set to reshape the European payment services market, driving growth and innovation. This Insight Page explores FiDA's expected pivotal role in open finance.

On June 28, 2023, the EU Commission published its payment and financial data access package as part of which the proposal for a Financial Data Access Regulation (FiDA) was published.

FiDA will create a unified framework at the EU level for regulated and consent-based sharing of financial data, categorized into personal and non-personal data.

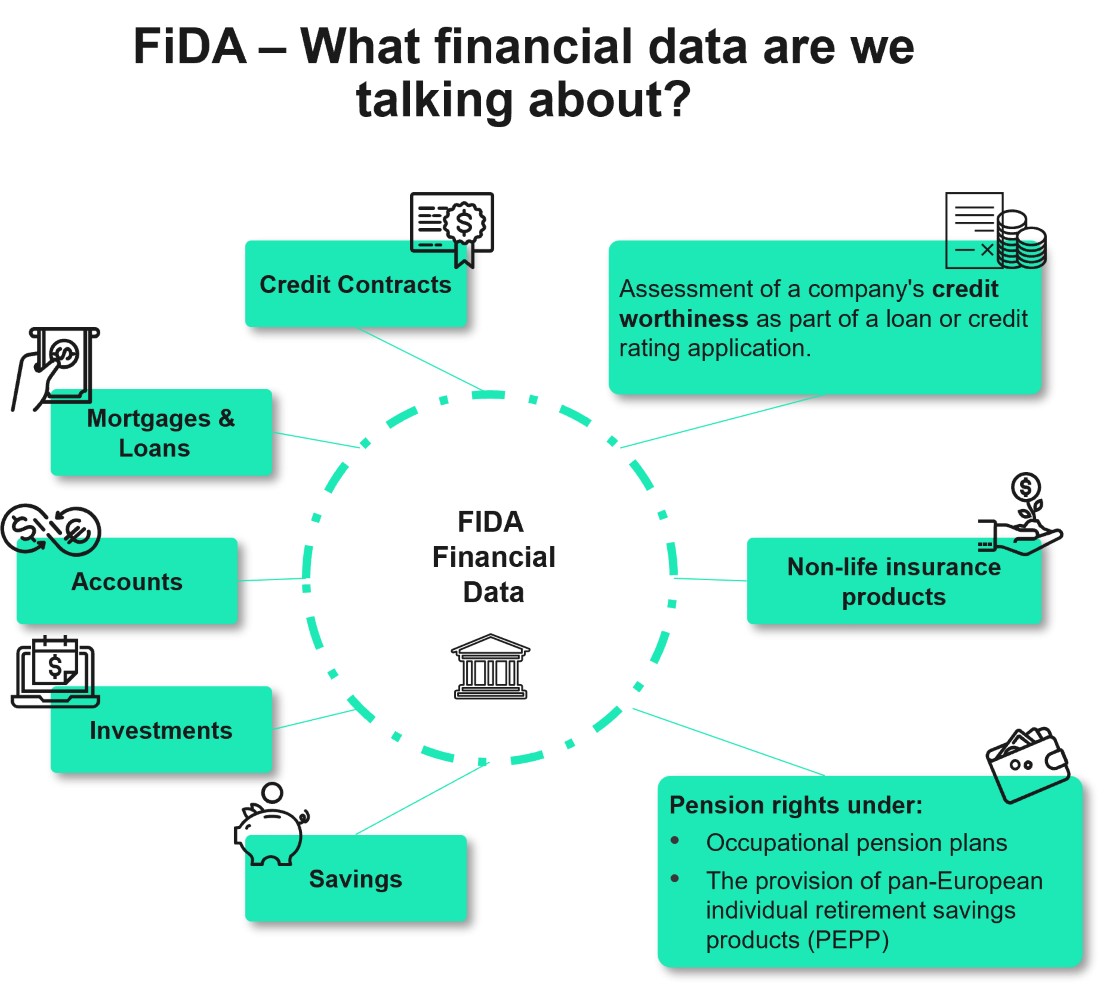

FiDA covers a wide array of customer data, offering valuable insights and detailed information to support various business needs and strategies.

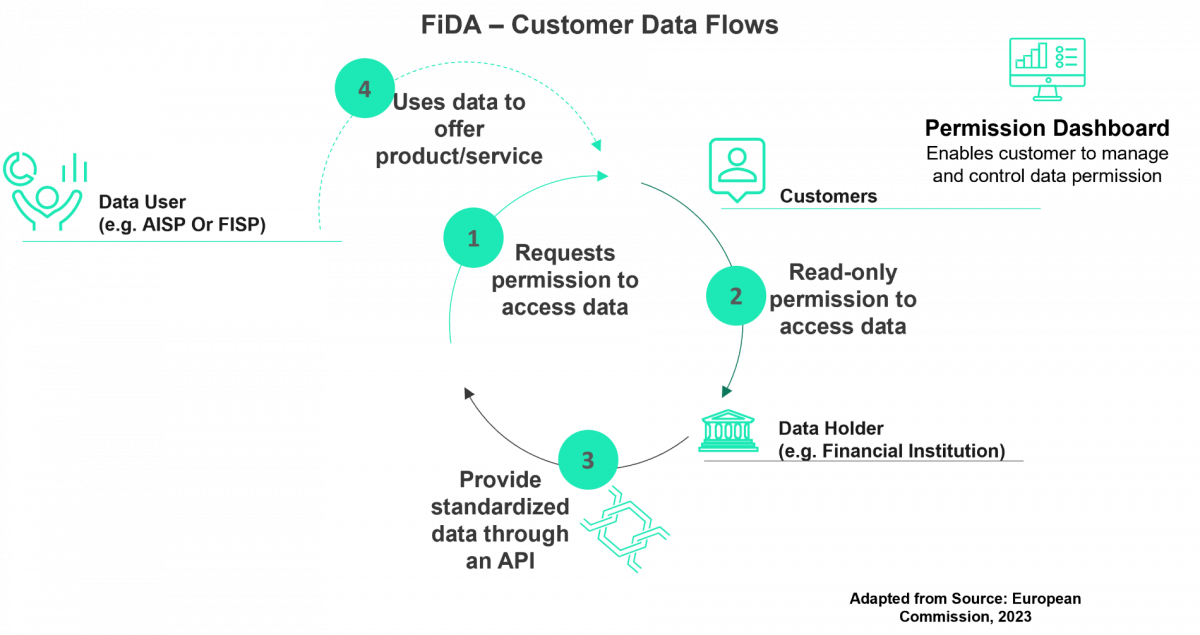

The below diagram illustrates how secure data transfers are expected to take place under FiDA. Customers must have access to a permission dashboard to manage and monitor their data, giving them complete control who has access to their data and for what purpose.

FiDA emerges within a regulatory framework already filled with many standards collectively designed to govern the entire payments/financial sector comprehensively.

FiDA complements GDPR, providing additional data access rights and ensuring data processing security. The innovations will therefore be purely operational and will merge into the mandatory activities that will be managed by the privacy team and the data protection officer.

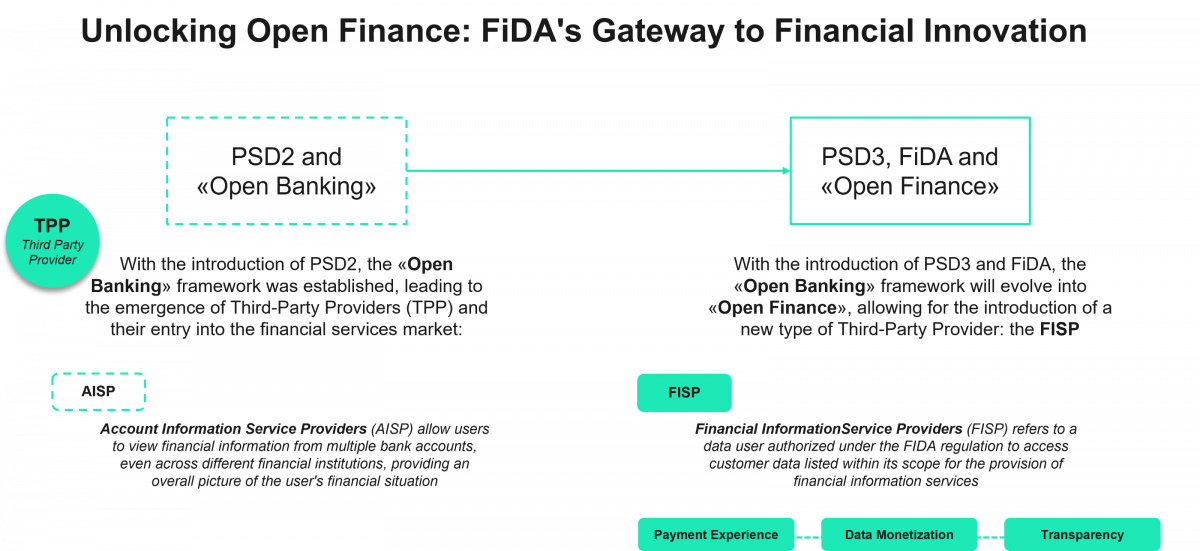

FiDA is positioned to drive Open Finance by establishing clear guidelines amidst the emergence of new digital technology-enabled providers in payment services, especially those offering 'open banking' services. While broader 'open finance' solutions beyond payments have been emerging, they have faced challenges due to the lack of defined regulatory frameworks. These solutions often rely on accessing data through interfaces set up by data holders for their customers, like the early stages of 'open banking' before the revised Payment Services Directive.

As any new regulation, FiDA brings along implications for financial institutions and consumers. Operational adjustments need to be implemented for data access and consent management and new data categories may have to be specified for mandatory sharing.

At Sia Partners, we are dedicated to supporting financial institutions to navigate the evolving landscape shaped by FiDA and Open Finance. Here’s how we can assist:

By partnering with Sia Partners, financial institutions can navigate the complexities of Open Finance confidently, ensuring sustainable growth and resilience in the digital era