From Data/AI Literacy to Fluency to Culture

Digital transformation drives all areas of the financial sector, including regulations. But what if it could be the other way around? This article will discuss how regulations in sustainable finance acts as an accelerator for digital transformation, generating deeper transformation than ever before.

International climate agreements are often criticized for not being binding enough. In an effort to turn its goals into reality, the EU has doubled down their 2019 Green Deal with a number of sustainability regulations aimed specifically at the financial sector, which is believed to have a great potential for impact. What is less obvious is how deep of an impact sustainable regulations are set to have on the financial sector itself. This article will explain how sustainable finance regulations are set to push the financial sector into a new age of digitalization, through top-to-bottom digital transformation. This article will first go through how sustainable finance regulations (SFRs) have been reshaping the regulatory landscape in finance in recent years, then dive into how digital transformation and financial regulation often come together. After that, it will discuss how sustainable finance’s regulation in particular has been, and will continue to, drive a new leap in digital transformation within financial institutions (Kaya, 2021).

As the effects of climate change are felt more every year, sustainability has become a growing priority on all levels of society and businesses. Consumers and voters become increasingly aware of its importance. At the same time, governments frequently collaborate around international treaties, and regulatory bodies simultaneously translate new requirements into updated rules. As one of the most heavily-regulated corporate sectors, the financial industry is at the heart of any government’s strategy to stay on track with their sustainability goals: most recently, during Glasgow’s COP26, participating governments pledged to mobilize at least $100 billion per year in climate finance[Kaya, 2021]. But to drive financial institutions towards such high achievements, they must be guided and encouraged by regulatory frameworks. Though it pre-dates the Glasgow conference, the 2019 European Green Deal was created with the ambition of driving change on such a magnitude, and a number of financial regulations fall under its scope.

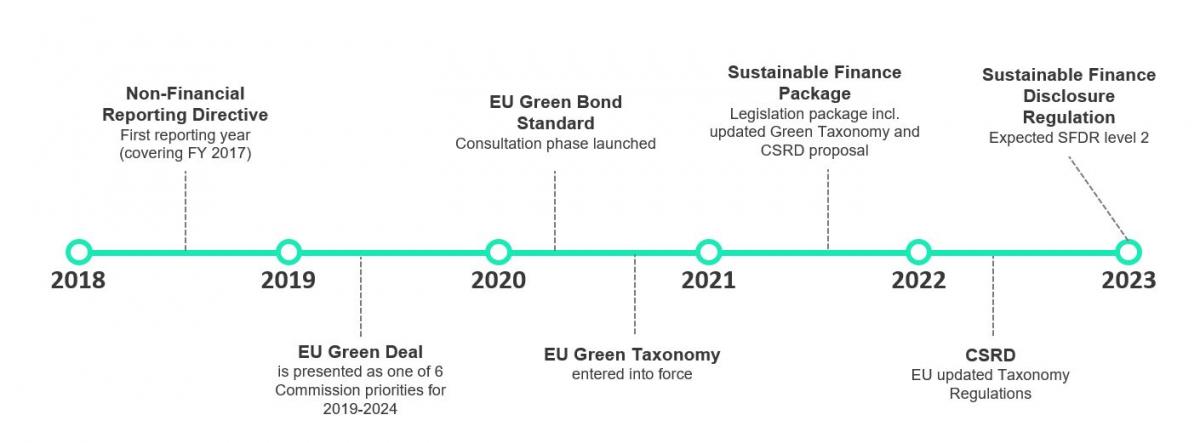

The EU commission’s website defines sustainable finance as “the process of taking environmental, social and governance (ESG) considerations into account when making investment decisions in the financial sector”[European Commission, 2021]. This takes a number of forms when translated into regulation: increased transparency (Carbon disclosure project, Sustainable Finance Disclosure Regulations,…), updated rules of conduct & investment (MiFID II ESG, ECB’s guide on climate-related environmental risks,…), and new financial products (green bonds, green taxonomy,…). In Figure 1 below, a roadmap summarizes some of the most important European SFRs in recent and upcoming times.

Figure 1 – Timeline of EU Sustainable Finance Regulations since 2018 (Source – Sia Partners)

New regulations always bring along their fair share of change, and sustainable finance regulations have proven to be no exception. In recent years, due to the overwhelming wave of digitalization, corporate change has often been addressed through digital tools. In the financial sector, the change induced by regulation has even created opportunities for a new market.

Digital transformation has been a long-standing topic in the financial sector, and has transformed financial institutions to their core already. Financial institutions (hereafter, FIs) have often been at the forefront of using new technologies and building sophisticated software to improve their processes. The Covid-19 pandemic has been one of the latest and most impactful accelerators of digital transformation across all sectors, finance included.

As a highly-regulated sector, FIs rely heavily on innovative technology to keep up with more demanding and stringent regulatory standards. The European regulatory and supervisory authorities oblige FIs to increase the scope of data and data granularity in terms of reporting. As a result, driving changes and investment within this area are required for the financial industry to keep up with the regulatory and supervisory expectation. These changes lead to exponential growth in the amount of data to be managed and reported on, which implies the underlying analytical systems have to keep up with these growing amounts. This can best be done, for example, through the use of machine learning and artificial intelligence (AI).

The spike in regulatory requirements created an opportunity within a new market: Reg Tech, which the European Banking Authority (hereafter, EBA) defines as “any range of applications of technology-enabled innovation for regulatory, compliance and reporting requirements implemented by a regulated institution” in their June 2021 analysis of the RegTech sector [European Banking Authority, 2021]. The market of RegTech-specific providers is set to reach a total size of $18.9 billion in 2025, according to research by GlobalNewsWire [Global News Wire, 2022]. In Europe, a majority (>60%) of the RegTech providers were founded in the last 6 years, according to a survey carried out by the EBA[European Banking Authority, 2021]. That same survey shows 75% of financial institutions already work with such providers, among which major market segments are AML/CFT (Anti Money-Laundering and Countering the Financing of Terrorism), fraud prevention, prudential reporting & ICT security (Information & Communication Technology Security). Refer to the figure below for the exact split among provider types used by the surveyed financial institutions.

Figure 2 - RegTech market segments - proportion RegTech solutions used by FIs (Source: EBA)

RegTech providers give FIs easier access to new technologies. Most often, they provide them with technologies such as data transfer protocols, cloud computing, data analytics, and machine learning. These are particularly intended to help manage and understand large amounts of data that have recently been introduced into the financial sector and regulatory requirements. Given the amount of data new regulatory standards tend to require, this naturally results in deeper digital transformation.

Figure 3 - FIs – technologies used through RegTech providers (Source: EBA)

The Harvard Business Review, in a 2022 article [Furr et al., 2022], defined four pillars to a successful digital transformation, two of which are crucial to the transformation brought about by regulatory changes: IT uplift and digitization of operations. On the one hand, an IT uplift, meaning the use of new technologies such as cloud computing, machine learning, etc., implies an update of the IT structures behind the operations that require reporting, to stay in line with capacity requirements. The growing use of RegTech is clearly a symptom of this phenomenon.

On the other hand, the different types of solutions that are used through RegTech providers are a form of not only outsourcing, but most likely digitizing an operation process that was previously more manual, or not even done. Given the complexity of reinventing a long-standing process such as regulatory reporting, it makes all the more sense to do it through a ready-made software solution rather than to mobilize internal capabilities in building one – hence also the attraction of the RegTech software.

SFR has been a particularly prominent area of regulation where RegTech has been utilized. Due to its particularly wide-reaching and paradigm-shifting nature, sustainability in finance and the regulation that comes with it prove to be a source of digital transformation unlike others.

The first major transformation that SFR brings to FIs is the demand for more granular data. Though data’s growing importance reaches far beyond sustainability issues, SFR gives it a particular importance. Due to its very broad scope, SFR demands new and updated data fields over most existing systems. Major financial institutions have already understood this: respectively in 2019 and 2021, Natixis and BNP Paribas published articles calling out the importance of machine learning and AI-capabilities for assessing the new data arising from sustainability-related issues. Wolters Kluwer, in a 2022 article, underlined that ESG data management could even go beyond just complying to regulatory requirements, and could actually improve sustainability plans and profitability for the bank as a whole: it can enrich budgets and cost analysis, support sustainable growth when incorporated into the business model, and can mitigate risks.

Another major reason for sustainable finance regulations to be paired with digital transformation is how often these regulations evolve: Figure 1 (roadmap in first part) shows the sheer amount of European SFRs in the last few years, and with climate change’s effects being felt more and more, that pace is unlikely to decrease in coming years. Top that with actual climate risks and events that may push FIs to rethink their business models and risk management, potentially on a moment’s notice, and you will have an acute need for very flexible and adaptable operational systems. As it happens, RegTech companies pride themselves in providing just that: over 60% of the surveyed RegTech providers in the previously mentioned EBA study stated “Reactivity and adaptability to changing regulation“ was the most important benefit they brought to their clients.

But regulators themselves must also strive to be more flexible as the pace of their requirements increases – not in how high their standards are, but in how much they collaborate with FIs to set the frame for new rules and requirements. The UK’s FCA leads this movement with its own regulatory sandbox (FCA, 2021) , their current pilot being exclusively dedicated to ESG issues. Aside from extended collaborations, regulators must also upgrade their technological capabilities should they wish to keep up with the new technologies the regulated institutions are using. Take for example the use of AI in ESG data: as a fairly new data topic, ESG is all the more open to bias in its related AI with recently-written and fairly untested code. To make sure this is reported correctly, regulators will need to be able to analyze and monitor the code behind the technologies used in a way that precludes the use of any unfair logic. AIs and several levels of intermediate programs can intervene before the data even makes it to regulatory reports, and the regulators will therefore not only have to check the data itself, but the manner in which it was provided to them.

Digital transformation is an all-reaching revolutionary phenomenon, and it makes sense that new regulations, whether they be in sustainable finance or not, should be part of its effect. Through both internal transformation and RegTech providers, SFR’s increasing importance within the financial sector is leading to major changes. However, sustainable finance stands out in that it is meant to be a revolution in and of itself – a regulatory push to steer finance away from short-term profit-chasing and into preserving the environment in the long run. Where digital transformation has thus far served to grease FIs margins, it may henceforth be accelerated for a metamorphosis that goes beyond the very principles of capitalism.