Control Room of the Future

Hydrogen is considered to be a legitimate solution to decarbonizing the transportation sector. It can compete with electric batteries on light mobility, but a global assessment is needed to definitively settle the question.

The transportation sector currently represents 22% of the European Union's greenhouse gas emissions (GHG) and is the leading sector in emissions in France (30%) [1] and the UK (29.8%). Meanwhile, due to its storable and transportable nature, carbon-free hydrogen is becoming a promising energy vector for the energy transition in segments where electrification is insufficient. However, with 96% of hydrogen being produced from fossil fuels [2] , decarbonising the production of hydrogen still remains a priority, as many countries aim to deploy it for mobility. In France and Canada, developing a hydrogen industry and increasing the production and use of low-carbon fuels are embedded in government plans worth nearly 1 billion euros [3][4]. While in the UK efforts are focused on heavy mobility, the Netherlands on other hand aims to deploy 15,000 light vehicles and 50 filling points by 2025.

The advantages of hydrogen in weight, range, and recharging time seem to make its use in mobility favorable. In addition, being pollution-free means this fuel is in line with regulatory developments, such as the European RED II directive, which requires a minimum of 14% of fuels to come from renewable sources, and the European Commission's commitment to achieving carbon neutrality by 2050, which implies a 72% reduction in emissions from the transport sector.

To determine whether using hydrogen for light mobility is consistent with the overall hydrogen production objectives in France. Sia Partners investigated the annual consumption for the deployment of 50,000 hydrogen vehicles. The study concluded that this scale of deployment would represent for example 8% of the French annual hydrogen production in 2030 and less than 1% of wind and PV capacities.

Battery electric vehicles (BEVs) have already demonstrated great potential for light mobility in urban areas, where recharging is accessible (especially with residential power stations) and range requirements are below 500km. When comparing the technical performance of BEVs and hydrogen vehicles, several arguments are in favor of BEVs.

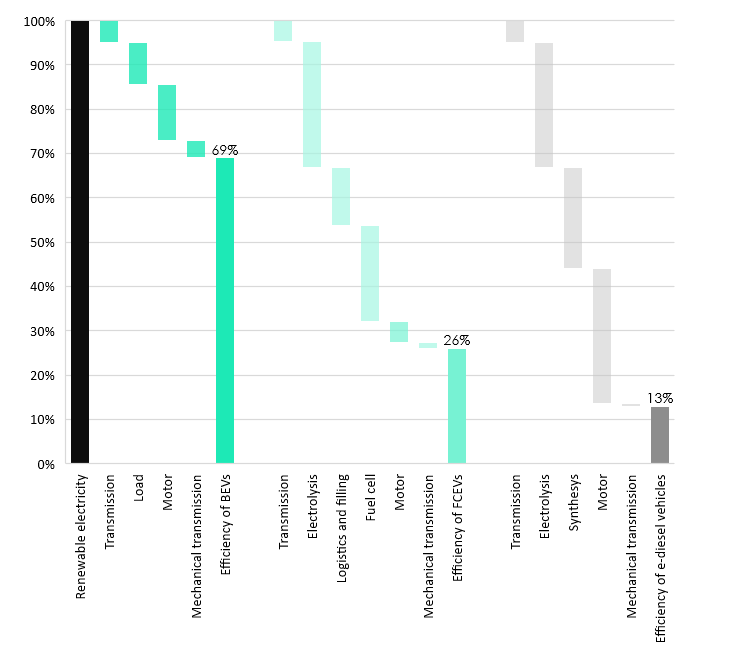

In BEVs, from the provision of electricity to the vehicle being driven (electricity-to-wheel), 30% of energy is lost, while fuel cell vehicles (FCEV) losses are 2.5 times greater at almost 75%.

Figure 1. Compared energy efficiencies of battery, fuel cell and synthetic fuel vehicles. Sia partners analysis is based on the royal society report « sustainable synthetic carbon based fuels for transport »

In terms of GHG emissions, the carbon footprint of electrical power generation makes hydrogen-powered light commercial vehicles (LCVs) and Sedans perform half as well as their battery-powered counterparts in the European energy mix. Although hydrogen vehicles are more carbon-intensive than diesel with the current EU energy mix, they perform considerably better in a 100% renewable mix. In any of these scenarios, BEVs generate fewer emissions than FCEVs.

Figure 2. GHG emissions over the lifetime of LCVs and Sedans. Analysis by Sia Partners, based on ADEME LCA data, September 2020 (min = alkaline electrolysis without transport of hydrogen to the station - max = PEM electrolysis with transport at 200bar over 50km)

Whilst the low efficiency of hydrogen solutions explains their slow development as an alternative to BEVs for light mobility, political and industrial factors can have also contributed to electric vehicles’ lead over hydrogen vehicles.

Until recently, western governments have prioritised the development of BEVs. While there are opportunities for the development of hydrogen, the reference scenarios of western countries' low-carbon strategies have aimed to achieve 100% new private electric vehicles in 2030 for the UK and Netherlands, 2035 for Canada, and 2040 for France.

These commitments have been implemented through plans to develop charging infrastructure, with an announced target of 100,000 charging points open to the public in France by the end of 2021, and 1.7 million by 2030 in the Netherlands. In the UK, over 1.5 billion euros has been invested by the government in the rollout of charging infrastructure. On the other hand, the development of a hydrogen refueling network appears more complex and costly than recharging points for BEVs, which rely on the existing electrical network. A hydrogen refueling station costs 1 million euros, compared to around 45,000 euros for an electric refueling station.

These significant investments made to promote electric charging do not interfere with the development of hydrogen along with BEVs, as a total of 83 000 hydrogen LCVs should be on the road by 2030 in France, Belgium and the Netherlands. However, the investments confirm the priority the governments have placed on the development of BEVs for light mobility.

European manufacturers have also opted for primarily producing electric vehicles, as illustrated by the French Renault Zoé, the best-selling electric car in Europe and the Nissan Leaf - produced in the UK - the third best-selling EV in Europe. Moreover, 17 manufacturers and 7 European Member States have joined forces in a consortium called the Battery Alliance aiming to develop the whole industrial sector of electric batteries in Europe.

In addition, BEVs are more affordable as they already benefit from a high level of technological maturity, as proven by the continuous decrease in battery prices, from $1,200/kWh in 2010 to $140/kWh in 2020 [5]. Over the same period, the price of hydrogen fuel cells (HFCs) had only decreased by 37%.

Figure 3. Average batteries and fuel cells prices, 2010 - 2020. Analysis by Sia Partners, based on Bloomberg and DOE data [7][8]

The institutional and industrial ambitions have thus allowed significant economies of scale for the electric industry and its take-off in France, creating new opportunities for retailers. However, light mobility with hydrogen can be relevant in some use cases.

Light hydrogen mobility can be relevant for captive fleets. Captive fleets are vehicles with predictable driving and refueling patterns that are managed together and use shared infrastructure. This is the case, for example, for cabs or utility vehicles. The shared operating mode makes it possible to balance the cost of charging stations by optimizing their location according to the needs of a specific fleet. In addition, the fast recharge time of hydrogen vehicles is critical for fleet managers, who try to minimize their fleet's downtime as much as possible. The Hype joint venture, which brings together Air Liquide, Toyota, Idex and the Société du Taxi Électrique Parisien (STEP), has deployed a fleet of 100 hydrogen cabs in Paris, refueled by four stations, and has the ambition to deploy 10,000 vehicles by 2024.

The use of hydrogen-powered utility vehicles is also of interest for company rounds with daily returns to the depot. It is suitable for deliveries beyond the "last mile", in particular for large payloads (a few tons). Renault has entered this market by offering a hydrogen version of its commercial vehicles: the Renault Kangoo ZE Hydrogen on the light mobility segment, and, as part of a joint venture with the American company Plug Power, the Renault Master ZE Hydrogen, planned for the end of 2021.

Hydrogen has some promising applications. Therefore, it is interesting to investigate a country's aptitude to produce the hydrogen needed for the development of FCEVs.

Sia Partners studied the impact of the deployment of 50,000 light hydrogen vehicles on the French national hydrogen production and renewable energy power generation capacities. [6]

| Light mobility - France | Consumption - yearly |

|---|---|

| Hydrogen consumption | 31 kt |

| Electricity consumption | 1700 GWh |

| Electrolyser | 8% France Capacity 2030 (500MW) |

| PV capacity | 0,61% France Capacity 2020 (2,7 km2) |

| Wind turbines capacity | 0,64% France Capacity 2020 (74 wind turbines) |

| CO2 emissions avoided | 484 kteq CO2 |

As seen in the figures above, requiring less than 10% of France’s total Electrolyser capacity, the annual consumption of hydrogen and renewable electricity related to the deployment of these vehicles would not challenge the hydrogen production capacities envisaged in 2030. What’s more, deploying 50,000 light hydrogen vehicles could avoid more than 480kt of CO2 emissions compared to their diesel equivalent.

In addition, the use of hydrogen is particularly well suited to an energy mix with a high proportion of intermittent renewable energies, in order to create value for the surplus electricity produced that would otherwise be lost due to techno-economic complexities of storage. This capability will also create additional decentralized storage and load shedding capacities, which could support the load balancing on the network.

Despite the technical barriers, Hydrogen provides unique opportunities for light mobility that are worth consideration, specifically in countries where producing low-carbon electricity may be challenging [7].

From a user perspective, hydrogen vehicles remain more expensive to buy and to fill up, and they benefit from a much more limited recharging network. Despite the expectations for the electrification of light transport, hydrogen remains a complementary alternative to BEVs. In particular, hydrogen could help to support grid congestions due to the deployment of both electric vehicles and renewable energies. Hydrogen vehicles could be a compelling solution in other types of mobility where the use of batteries is more difficult particularly because of the recharging time, and the low range.

[1] Emissions 2018 (UTCATF excluded). From : Chiffres clés du climat 2021, SDES.

[2] European Commission: https://ec.europa.eu/energy/topics/energy-system- integration/hydrogen_en

[3] Stratégie nationale pour le développement de l’hydrogène décarboné en France, Dossier de Presse, Ministère de l’Economie, des Finances et de la Relance, Septembre 2020

[4] Minister O’Regan Launches Hydrogen Strategy for Canada

[5] Source : Bloomberg

[6] High range of the French target (Programmation Pluriannuelle de l’Energie), 40,000 sedan type vehicles - 10,000 LCVs. Production from hydrogen connected to ENRs only. The following parameters have been used:

[7] For instance, in Japan the high cost of renewable energy justifies a large-scale deployment of hydrogen, imported from Australia.