Control Room of the Future

E-fuels have emerged as a promising solution for decarbonizing hard-to-abate sectors, notably, air and maritime transport. The International e-Fuels Observatory offers an analysis of 77 large-scale global projects, with a capacity equal to, or exceeding, 200 ktoe per year.

This International e-Fuels Observatory, conducted by Sia Partners for the French E-Fuels Office, aims to provide an overview of the sector dynamics, worldwide, and the challenges of mobilizing resources for six synthetic fuels with promising market potential: e-methane, e-methanol, e-kerosene, e-ammonia, e-gasoline and e-diesel.

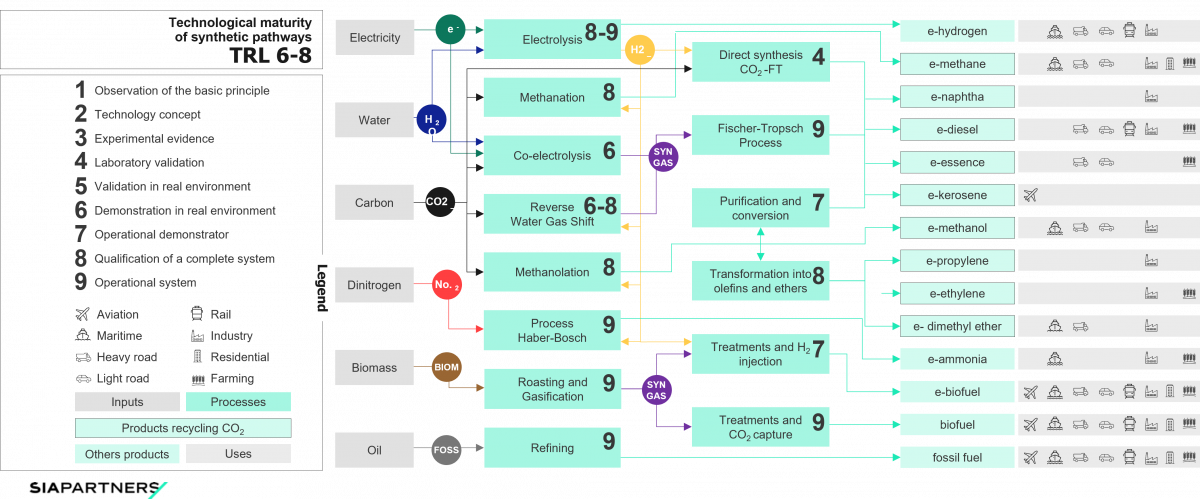

The 6 E-fuels mentioned above are obtained from hydrogen generated by electrolysis of water powered by carbon-free electricity, and recycled carbon from industry, bioenergy plants or captured in the air.

For this reason, e-fuels stand out as a crucial decarbonization solution for industrial inputs and heavy mobility, complementary to electrification.

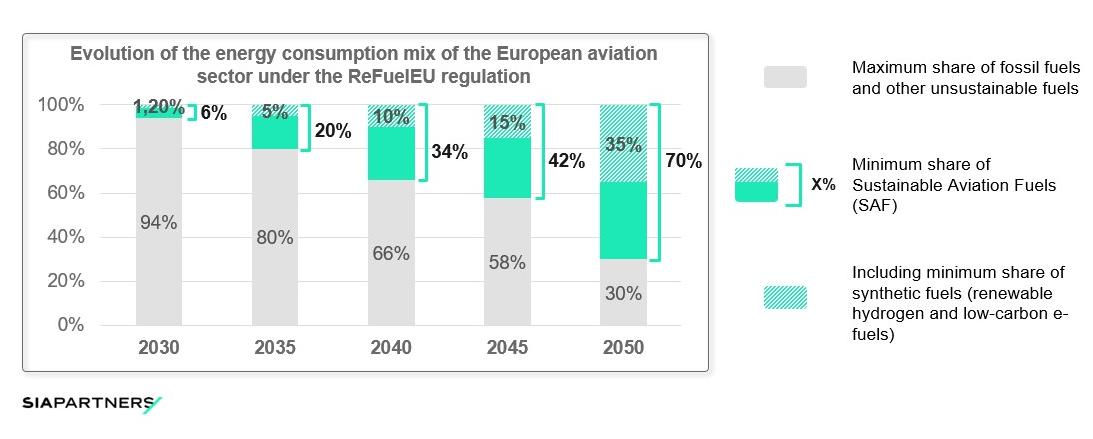

To encourage the development of e-fuels and benefit from its potential, governments have already taken some measures, especially in Europe where regulatory obligations have been implemented to mandate some uses of e-fuels, giving it an increasingly important role in our energy mix.

The French E-fuels Office initiated the first edition of the French e-fuels Observatory in July 2023. Conducted by Sia Partners, this Observatory provides an assessment of the potential development of a French e-fuels industry based on existing initiatives and estimates the requirements for deploying this new value chain.

It concludes that the implementation of the projects announced to date would avoid the emissions of 1.7 MtCO2 while creating 3,000 direct and indirect jobs and reducing the trade balance by €506 million. The realization of the estimated potential would require the mobilization of 14 TWh of decarbonized electricity.

Through this report, the French E-fuels Office wanted to put these results into perspective with the international context and compare France to other countries.

The International E-fuels Observatory, conducted by Sia Partners, provides an overview of the development of the e-fuels sector worldwide, with a focus on the industrial context and challenges for some of the most mature countries in Europe and North America: Denmark, Sweden, Spain, Canada, and the United States.

As e-fuels appear to provide a tangible solution for transitioning away from fossil fuels, because of their decarbonization potential, they appear to be the key tool for transitioning sectors. Especially air and maritime transport, but also some industries that were thought to be without alternatives up to now. E-fuels offer great potential for renewable energy storage.

E-fuels are all the more interesting as they appear to be a ready-to-use solution. The synthesis of e-fuels requires the use of technologies that have reached a good Technology Readiness Level (TRL 8-9) and can be used directly in existing internal combustion engines. For this reason, e-fuels production projects are emerging all over the world. Thus, the race for e-fuels is launched, offering new perspectives and competitive advantages to countries investing in it. The industrialization of e-fuels production presents both opportunities, and challenges that are investigated in the International e-Fuels Observatory.

According to Charlotte de Lorgeril, spokesperson for the Office, and Partner in Energy, Environment & Utilities at Sia Partners: “The first French e-fuels Observatory published in July 2023 aimed to provide insights into the specific challenges for France in developing new national value chains. This exercise sparked numerous reactions from stakeholders in the French ecosystem, reflecting questions about these still-emerging solutions. This new International e-fuels Observatory aims to provide an understanding of the challenges of cooperation, complementarities, and competition among the most mature countries on these issues.”

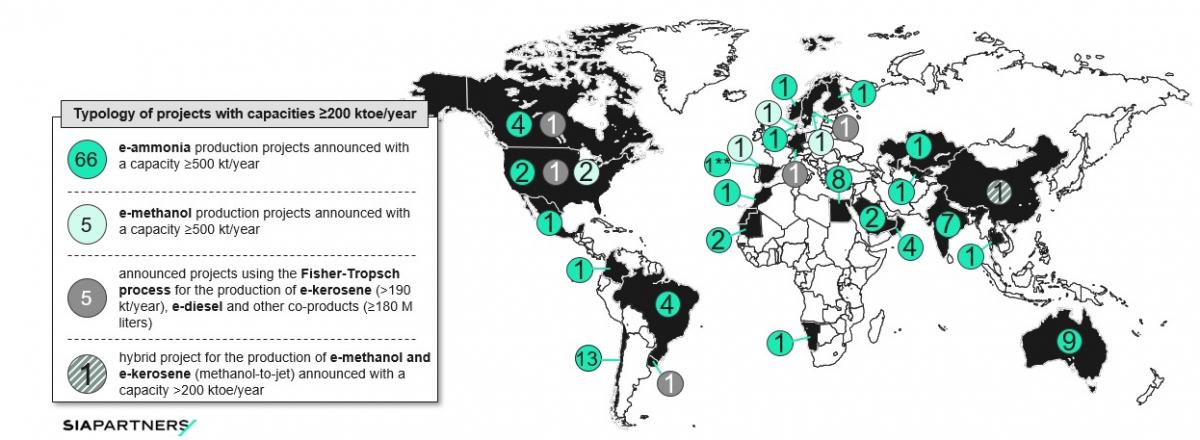

The global dynamics of the e-fuels sector appear exceptional; more than 500 e-fuels production projects are documented worldwide by the International Energy Agency, spanning all continents and varying greatly in size.

The International E-fuels Observatory provides an analysis of 77 large-scale global projects, each with a capacity equivalent to, or exceeding, 200 kilotonnes of oil equivalent (ktoe) per year. This represents, for each project, the energy equivalent of at least +1,300,000 individual journeys from Paris to New-York.

These large projects are primarily located in areas with a high potential for low-cost renewable electricity production or with few issues related to land and local acceptance of large industrial projects, notably in Chile, North Africa, the Middle East, the United States, Canada, and Australia.

85% of the projects focus on e-ammonia production, currently a means of transporting hydrogen, with the main market being nitrogen fertilizer production. Most of these projects are geared towards export, with only 19 located in major consumer countries in North America, Europe, and Oceania.

The remaining 15% of projects target e-methanol or e-kerosene production, for industrial decarbonization and as maritime and aviation fuels. Unlike e-ammonia production, these projects require significant amounts of carbon, while qualified and concentrated sources are limited. Their location is therefore more constrained, with most situated in future major consumer zones in Europe and North America.

Beyond these large-scale projects, hundreds of smaller-scale projects (10 to 150 ktoe) are located worldwide, particularly in Europe and North America.

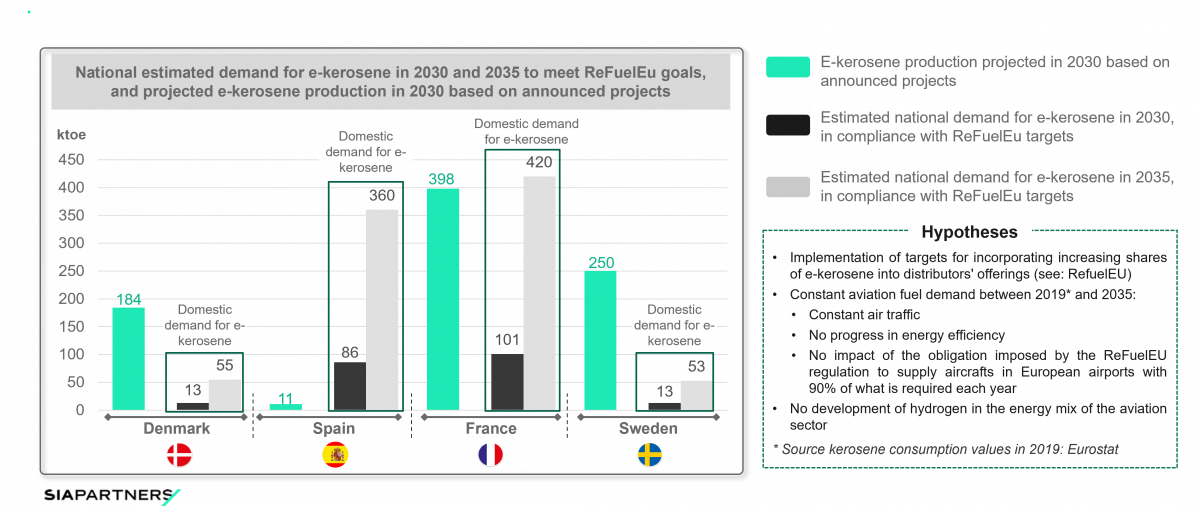

The production volume of projects announced in France amounts to over 630 ktoe, including nearly 400 ktoe aimed at producing aviation fuels. In this field, France stands out as a pioneer compared to other European countries studied in detail by the International e-fuels Observatory.

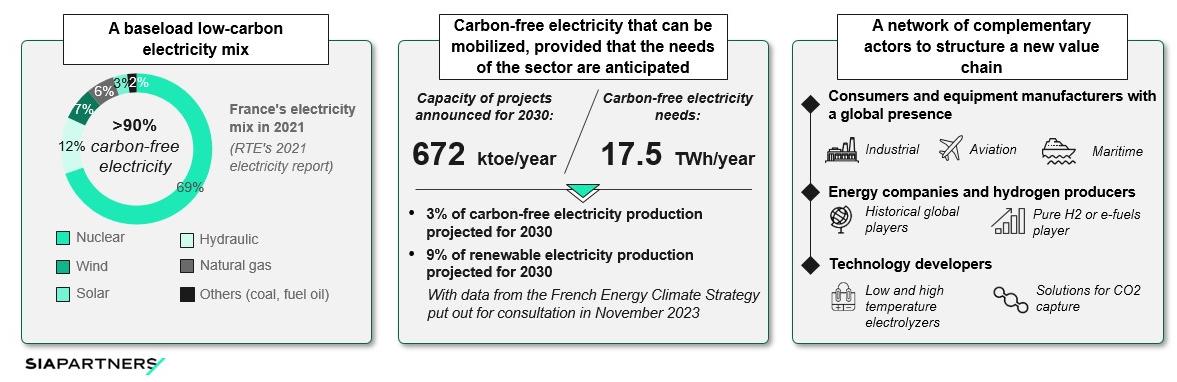

France has several advantages; a significant amount of low-carbon nuclear electricity available throughout the year as a baseload, industrial and port platforms with their engineering ecosystems, a strong presence in the aerospace and maritime sectors, and the availability of biogenic CO2 to meet the short-term needs of the industry.

It also hosts key players throughout the value chain: end-users of these molecules, global energy leaders, industrial companies, technology developers, and financial institutions, banks, and infrastructure funds.

The following articles are available in French.