Canadian Hydrogen Observatory: Insights to fuel…

What is the purpose of the new ring-fencing rules and what do they include?

The last financial crisis, highlighted that leading institutions need to be better prepared to withstand a variety of shocks as well as having better defined plans on what to do in case things do go wrong – improving so-called resilience and resolvability.

Recently the Basel framework for Global Systematically Important Banks (G-SIBS) has incorporated this core requirement via European wide legislation and at a local level in the UK via the PRA and FCA.

In the UK, this will be achieved through 2 key pieces of legislation:

The PRA released its framework for the SRB in May 2016 and its first policy statements on the implementation of ring-fencing in July of the same year (PS 20/16 and 21/16)

Since then the PRA, supported by the FCA, has released several consultation papers to inform its further development of the ring-fencing requirements. Based on these, the following policy statements have been released:

Both the SRB and ring-fencing requirements will come into effect from 1st January 2019.

Banks and building societies with average core deposits of more than £25 billion for a three year period will fall under the new ring-fencing legislation and be subject to the Systemic Risk Buffer (SRB). Currently there are six banks in the UK, namely HSBC, Barclays, Lloyds Banking Group, RBS, Santander UK and the Co-operative Bank.

As noted by the Bank of England, ring-fenced banks are not currently in existence. Their advice to date is thus based on evolving ring-fencing plans of the UK’s leading institutions, in the build up to the January 2019 deadline. The PRA will also be required to identify “Other Systemically Important Institutions” (O-SIIs) and would constitute a wider scope than those included in the SRB.

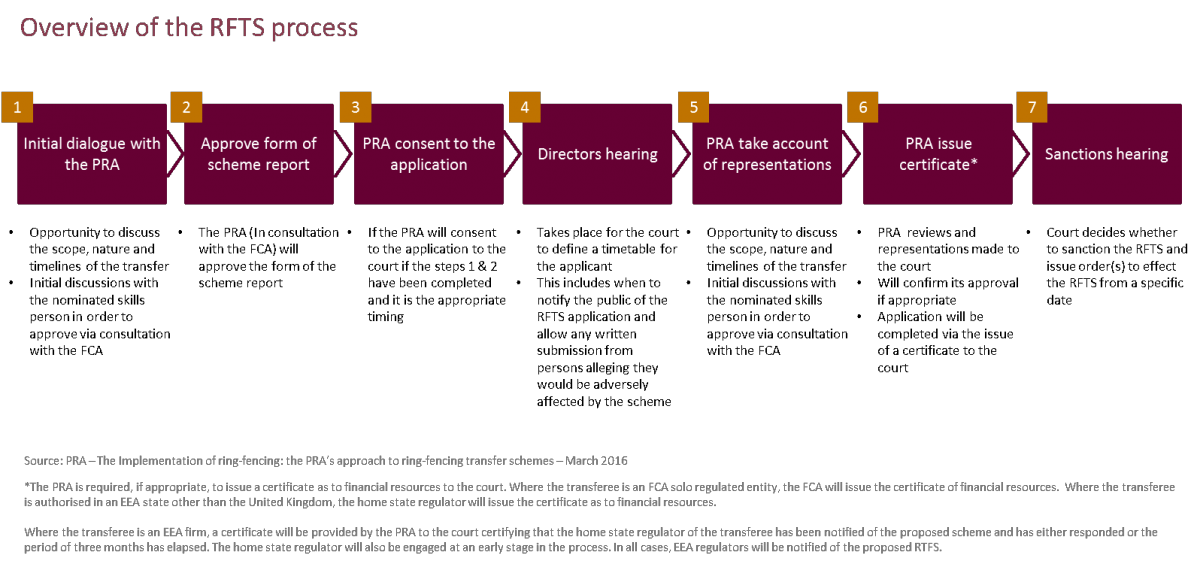

RFTSs will play a crucial role for those banks undertaking ring-fencing activities for January 2019. It will allow firms to transfer parts of the bank’s operations in order to comply with ring-fencing requirements. In effect, it is an instrument under Part VII of the 2000 FSMA act providing for a process leading to a court order to facilitate transfers of business. Using this mechanism will avoid the need to ask the consent of every individual bank customer. However, a Skilled Persons report will need to be compiled evidencing that no customers will be adversely affected.

As an example the RFTS might be used to move core activities to the ring-fenced bank RFB), or transfer “excluded activities” to other authorised entities. Banks will be able to apply to the High Court to sanction the transfer of business operations from one entity to another. The process defined by the PRA can be found below:

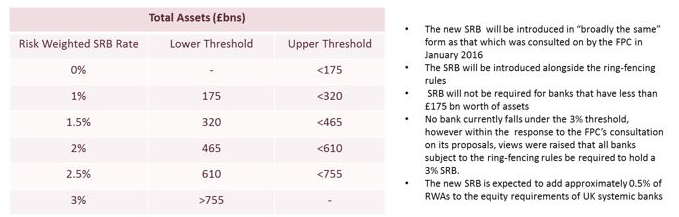

The SRB will be an additional buffer of equity capital, in addition to the capital requirements that Banks of systematic importance must have in place by 2019. The Bank of England has proposed to set SRB rates ranging from 0% to 3% based on the level of Risk Weighted Assets (RWAs). The Table below outlines the proposed asset thresholds:

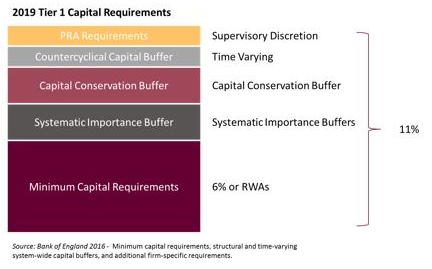

Banks falling under the SRB requirement will also be subject to a 3% minimum leverage ratio requirement, plus an additional leverage ratio buffer of 35% of the applicable SRB rate. When you total up the proposed 2019 Tier 1 capital requirements, it is expected to hit 11%.

The new regulations will pose many different challenges to firms and the industry.

Firms subject to the ring-fencing rules will have to consider:

The indirect impact centres around the fact that the rules don’t apply to all banks universally, creating an asymmetry in how banks are regulated based on the size of the deposits they hold. As a result, banks that are over the threshold and thus subject to the rules will need to additionally consider:

In addition, the ring-fencing rules will also create a significant industry wide concern during the lead up to and during early implementation around the potential for fraud. Where banks are moving accounts between entities, customer sort codes will change, and in some cases account numbers too. There is therefore a significant potential for fraudsters to impersonate banks in emails to customers and divert or subvert payments. The PRA and FCA are working closely with the affected banks to ensure customer communications are thorough and well-communicated to minimise this risk. However, it remains a significant concern that will need to be closely watched.

There is certainly much for the UK banks and the industry to think about in the lead up to January 2019. Firms will have to consider not only how to structure themselves but also the implications that will have for how they conduct their business in the long run. Lloyds and RBS for example have indicated they could include some operational activities inside their ring-fenced units, stating that their other operations lack the scale to be systemically important. More immediately, the industry and the regulator will need to consider how to minimise, if not eliminate the potential for customer fraud to occur over the next 2 years as the impact of the regulation on the public becomes increasingly visible.

What is beyond doubt is that structural reform is a key challenge for UK banks that will become more critical and visible as the deadline nears.