Fortune 100 response to DE&I pressures

Urban developments and air transport innovations are enabling new urban air mobility services. This transformation is driven by: a new generation of aircraft (VTOL), advanced air traffic management, and infrastructures in harmony with the territories.

The current momentum around UAM makes the observatory approach even more relevant, especially given our involvement in mobility topics, in close collaboration with key UAM ecosystem players such as mobility infrastructure managers, local authorities, and others.

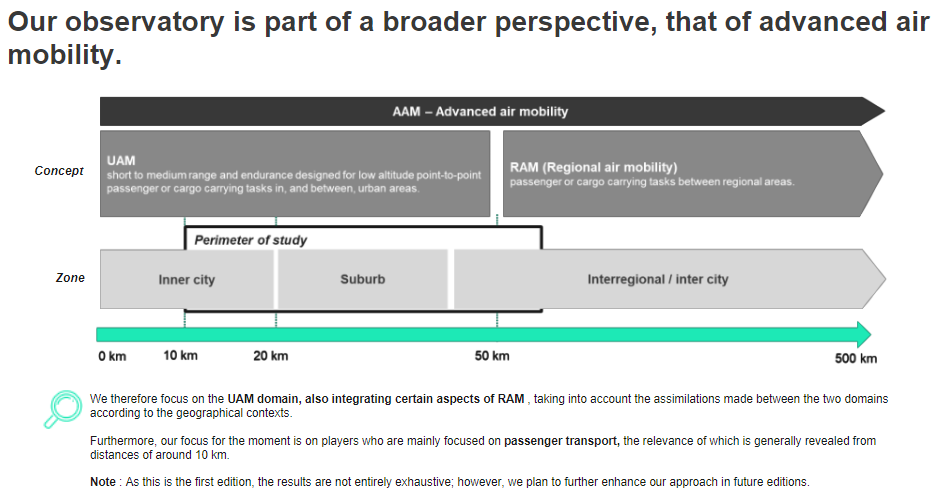

Our observatory fits into a broader perspective, that of advanced air mobility (AAM). We therefore focus on the UAM sector, while also considering certain aspects of RAM (Regional Air Mobility), given the overlaps between the two domains depending on geographical contexts.

Additionally, our attention is currently directed towards players primarily focusing on passenger transport, which typically becomes relevant for distances around 10 kilometres.

In this context, multiple objectives have been defined to develop a collaborative approach with UAM stakeholders:

Map the growth of the global UAM market and identify UAM pure players.

Identify the key business models followed by these actors.

Map UAM initiatives in development and characterize current trends around them (geographical areas, partnerships, types of projects, etc.).

Analyse the regulatory maturity of the main geographical areas involved in UAM projects.

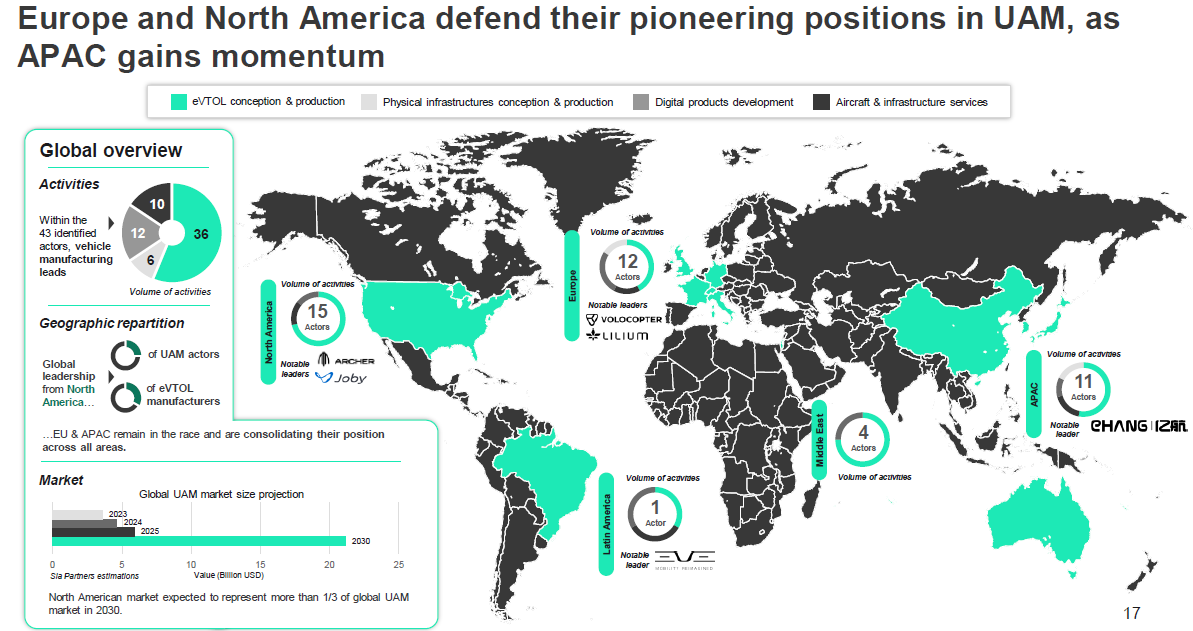

1. Europe and the USA maintain their pioneering positions in the sector

Together, they account for over 60% of the pure players identified, but the momentum is gathering pace in the Asia-Pacific region.

2. The UAM ecosystem remains young and is set to evolve significantly over the next few years.

More than 75% of the players identified are small structures with fewer than 500 employees, and almost half of them have fewer than 50 employees.

eVTOL manufacturing is the most represented field of activity, however, over 60% of the players involved are still only at the design stage.

3. The growth in UAM projects worldwide should make it possible to launch the first commercial services by 2025-2026.

More than 80 projects listed in the scope of the selected players, nearly half of which involve launching a UAM service.

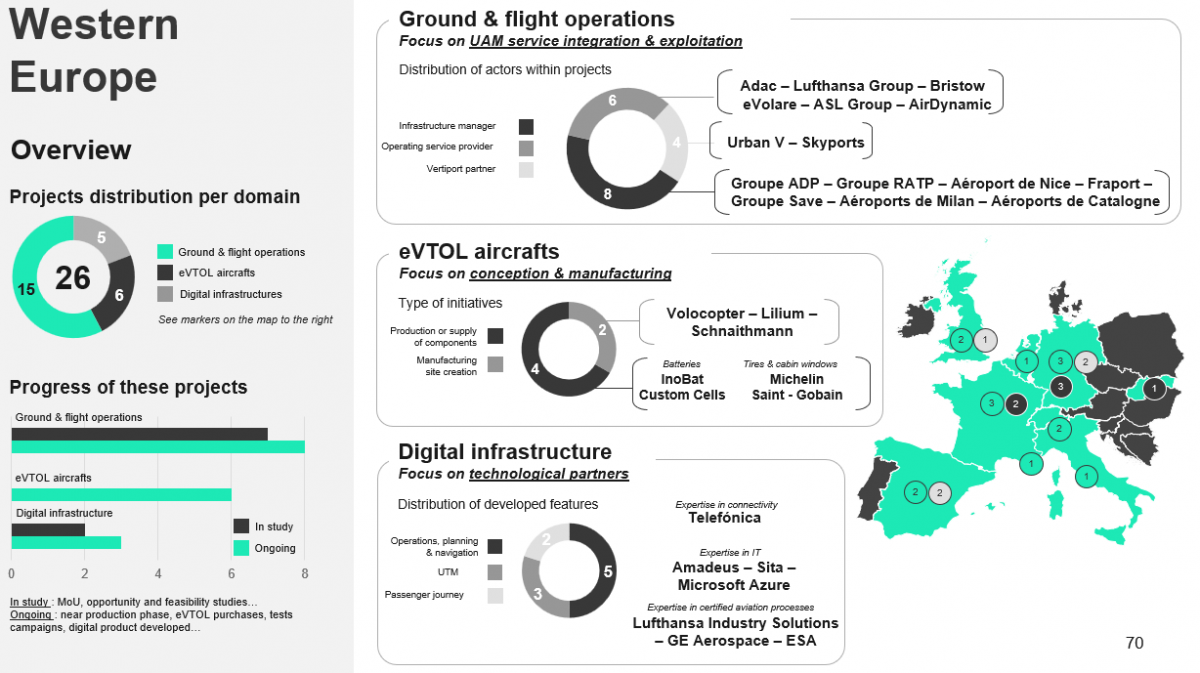

Specific trends emerge according to the geographic zones studied (predominant business model, traditional players involved, etc.), given their intrinsic characteristics...

4. Skills required in the sector must be anticipated, and relate to three major challenges

Avoid a shortage of pilots and technicians: Boeing projects a need for over 600,000 people in each of these positions by 2043, for commercial aviation, without taking into account the possible needs of the UAM sector over the same period.

Guarantee regulatory compliance: by investing more in UAM-specific training to meet new standards.

Adopt new technologies in the air transport sector: on which UAM relies heavily (automation of operations and air traffic management, etc.), requiring specialized training to guarantee the scalability of these services.

5. Air transport infrastructure managers have a key role to play in scaling up these services and are increasingly visible in UAM initiatives.

They can play a key role in addressing the challenges of integrating and operating a UAM service, particularly in three areas: infrastructure availability, ATC service management and network operations.

Why?

Essential air transport infrastructures already in place, and proven expertise in their management.

Air traffic control (ATC) services with which airports are familiar.

Potential synergies through numerous partnerships with traditional airlines (optimized use of runways, enhanced mobility offers, improved logistics management, etc.).

Increasingly developed intermodal connectivity (train, metro, etc.).

At the same time, these infrastructure managers are also used to dealing with other challenges facing the UAM, such as acceptance by the surrounding community (noise, visual nuisance, etc.), certification, etc.