Control Room of the Future

Between the summers of 2017 and 2018, long-haul flights between Europe and New York operated by low-cost long-haul airline Norwegian have, for the first time, carried more passengers than those of traditional airline British Airways (1.67 million passengers for Norwegian).

Between the summers of 2017 and 2018, long-haul flights between Europe and New York operated by low-cost long-haul airline Norwegian have, for the first time, carried more passengers than those of traditional airline British Airways (1.67 million passengers for Norwegian) [1]. Departing from Paris this summer, there were more low-cost long-haul carriers than conventional airlines offering flights to the United States (6 to 4) 1. Norwegian offered 4 times as many flights departing from Paris than in the summer of 2017 [2].

For the time being, these low-cost flights remain mostly provided in major world hubs and European capitals. But the rise in power of low-cost long-haul (LCLH in short) carriers leads more and more airports to consider the possibility of hosting them.

This new airline category, as well as the increase in long-haul air traffic (5-7% increase per year between Europe and the United States [3]) will have an operational impact on airports both on arrivals and departures. In the rest of this article, various impacts of the LCLH model will be discussed throughout the route of the aircraft, from the moment it lands until it takes off.

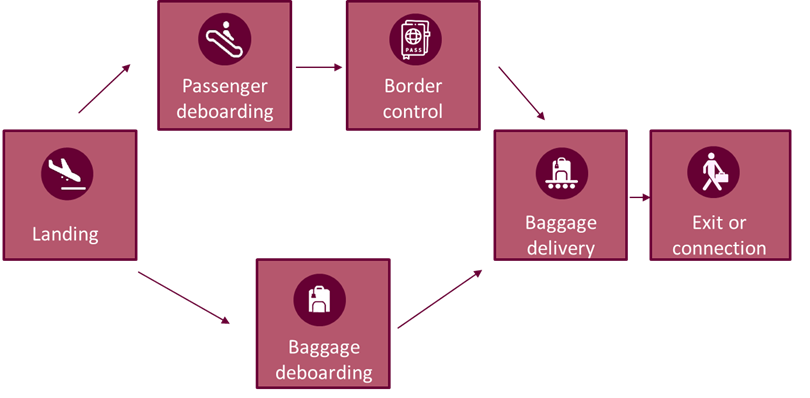

Impacts on the arrival course :

Figure 1 – passenger and baggage departure course

After landing, the plane heads to the terminal to disembark passengers. The first impact of the LCLH model is on the terminal choice. Indeed, while the fleets of short and medium-haul low-cost airlines are composed of aircrafts carrying less than 180 passengers such as the A319 (156 seats for EasyJet), low-cost long-haul aircrafts with 250 to 300 passengers (a B787-900 has a capacity of 309 passengers at Norwegian) require terminals equipped with arrival and departure halls that are able to bear the flow. Airports who decided to dedicate a terminal to low-cost airlines have mainly adapted these terminals’ infrastructure to the capacity of low-cost aircrafts (less than 180 passengers).

To reduce their usage fees, low-cost airlines are likely to park at a distant station accessible only by runway buses or pedestrian pathways. This is the case of Terminal 3 at Charles de Gaulle airport, served only by runway buses, and which hosts the Canadian carrier AirTransat and LCLH airlines WOW Air and XL Airways [4]. However, this terminal is not sized to accommodate a large number of international flights simultaneously: it has a single arrival hall outside the Schengen area and only 3 baggage carousels.

Faced with this situation, airports have multiple options : (1) offer the same infrastructure for low-cost long-haul airlines and standard long-haul airlines, at the expanse of being met with the latters’ demand for negociating their fees, or (2) accomodate their low-cost terminals to host long-haul aircrafts. Expansion projects for departure and arrival halls, increasing the capacity of delivery belts, or improving the passenger routing process are then feasible prospects.

Before picking up their luggage, passengers go through customs. This step is mandatory for all passengers coming from outside the Schengen Area and who aren’t on a connecting flight. There often is a connecting circuit allowing direct access to departure halls without going through customs or baggage delivery.

So far, LCLH connecting passengers cannot benefit from these circuits because they need to collect their luggage. This practice, called "self connect", consists in letting passengers manage their connections without any assistance.

Passengers must necessarily go through customs at each stage of their journey which results in an increasing number of controls, and options to deal with them are limited:

In summary, the last two options are the most feasible but require a reorganization of space and infrastructure dedicated to customs.

After passing through customs, passengers get to the arrival hall to collect their luggage. Unlike conventional long-haul flights, there is still no automatic baggage transfer in 2018 for LCLH connecting passengers. The sizing of infrastructure and resource planning must allow the delivery of luggage on large carousels: approximately 250 to 300 pieces of luggage must be delivered for each flight.

In the previous section, it became apparent that better efficiency at customs was necessary to avoid potential delays for LCLH "self-connect" passengers. The baggage delivery process and customs process take place simultaneously. Thus, a high efficiency of the border control process will only be effective for LCLH "self-connect" passengers if it is associated with an efficient baggage delivery process.

Therefore, the third impact of LCLH on airports is optimizing the baggage delivery as well as the infrastructure used (such as conveyors) to ensure that delivery of more than 250 pieces of luggage per flight are made in time. This would avoid potential delays for LCLH “self-connect” passengers who have a limited time to retrieve their luggage and go through the entire baggage check in process once again.

Once they retrieve their luggage, LCLH passengers whose airport is the final destination share the same exit as other passengers. Yet many passengers have multi-leg flights. Indeed, in 2017, the rate of long-haul passengers connecting to Paris Charles de Gaulle was 30.6% [5]. For "self-connect" passengers, i.e. those who bought a ticket on another flight to get to their final destination, a new process comes into play.

Excluding LCLH, in almost all major international hubs, connecting passengers are handled as soon as they arrive to the terminal, with a dedicated route enabling them to avoid customs (since they do not enter the territory) as well as the delivery of their luggage (which is checked-in automatically for their next flight).

For LCLH passengers however, there is no dedicated path. They must follow the traditional arrival flow, i.e. go through customs, claim their baggage, and then follow the departure flow: check in their luggage and pass the screening. In order to facilitate the path between the arrival and the departure halls, airports are starting to adapt their signage and create simplified flows. For instance, airports such as London Gatwick or Kuala Lumpur in Malaysia have created dedicated “self-connect” flows, with dedicated baggage checkpoints and a fast track for screening.

Therefore, the fourth impact of LCLH on airports is adapting the signage and paths for “self-connect” passengers who must claim and check in (again) their luggage during their connection.

In international hubs, this "self-connect" passenger journey might raise questions about terminals for LCLH airlines. Should they be placed close to low-cost short and medium-haul carriers to facilitate connections, at the risk of creating low-cost hubs and cannibalizing the hubs of conventional airlines (such as the one of Air France at Paris Charles de Gaulle or British Airways at London Heathrow)? For the moment, at Paris Charles de Gaulle, LCLH airlines are split between halls 1 (Norwegian), 3 (WOW Air and XL Airways) and 2D (EasyJet, the main Low-Cost airline in the region). Air France, which concentrates 50% of the platform's traffic, operates from terminals 2E, 2F, 2G [6] [7].

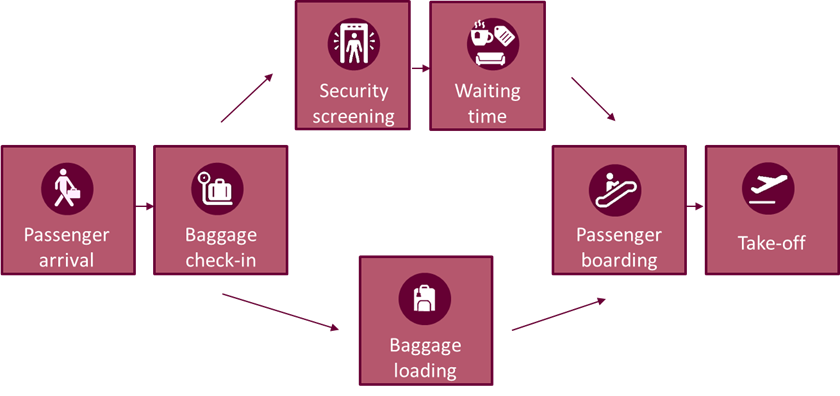

Impacts on the departure course :

Figure 2 - passenger and baggage departure course

Just as low-cost medium-haul carriers, LCLH airlines encourage their passengers to check in online before arriving at the airport. This reduces the required time for passenger registration as well as the number of check-in counters, which are then only used for luggage check-in. Just as there are now kiosks for self-printing boarding cards, airports are also starting to install self-service baggage kiosks. This makes it possible to meet the needs of low-cost airlines, to reduce the costs of airport fees, and to reduce registration times (self-service drop-off kiosks allow the processing of 60 pieces of luggage per hour when a traditional counter handles on average 24 per hour) [9]. Installed in a new "self-connect" path, these self-service baggage kiosks will also streamline this new route for connecting passengers.

The impact of the LCLH model on the baggage check-in will mainly focus on the flow of connecting passengers, who must check in their baggage in a short period of time.

Once their baggage is checked in, passengers go through a security screening process. They must pass through a security gate, and their personal belongings are scanned. As with baggage check-in, airports such as Gatwick in London have set up a specific path for connecting LCLH passengers during the screening process.

Low-cost airlines charge additional fees for checked baggage. Passengers thus tend to fill their cabin baggage, which remains free most of the time, impacting the transit times per passenger at the screening inspection stations. The integration of LCLH airlines in conventional terminals will therefore impact the sizing and planning of material and human resources for the screening inspection.

At the baggage loading level, two zones coexist:

The loading of baggage in cargo holds usually starts between one hour and half an hour before the scheduled departure time of the flight. The LCLH model is primarily based on point-to-point direct trips. In long-haul terminals that will accommodate LCLH carriers and conventional long-haul airlines, depending on the proportion of LCLH flights, the number of connecting passengers (excluding those in "self-connect") will tend to decrease, therefore decreasing the number of bags in the storage area. On the contrary, the sorting zone must increase its capacity to ensure an additional volume of luggage.

Thereby, airports must study the possibility of modifying the infrastructure to allocate more space to the sorting area.

The departure hall consists of the entire area following the screening process. In major airports, it includes duty-free stores, restaurants, shops, lounges and waiting rooms.

This step in the passenger journey is important for airports as non-aeronautical sales generated by businesses and services represent a significant part of their revenue. These businesses and services (shops, restaurants, bars, banks, foreign exchange counters and generally all paid services in the airport) represented 26.3% of the turnover for the Paris Aéroport group in 2017 [10].

The goal for airports is to have passengers spend as much time as possible in this area. If they arrive a few minutes before boarding, they will be less likely to spend time in shops or restaurants. On the other hand, arriving more than an hour before boarding increases chances for passengers to be tempted by an impulse buy, or drinks and food in bars and restaurants.

For low-cost long-haul passengers, the impacts can be broken down into those related to retail, and those related to restaurants.

As far as retail is concerned, low-cost customers are more price-sensitive than those of conventional airlines. Shops and duty-free stores must take this difference into account to adapt their offers. In terminals hosting LCLH carriers, just as those hosting low-cost short-haul airlines, the focus could be on mainstream brands rather than duty-free shops.

As far as restaurants are concerned, connecting passengers will often have no other choice than eating or drinking at the departure hall. On long-haul flights lasting up to ten hours, passengers will need to eat at some point, either on board or during their stopover. In the LCLH model, in-flight meals are, for most airlines, not included [11]. The price being one of the major factors of the choice of a LCLC flight, passengers want to be able to eat at the best possible price. Therefore, they will be inclined to compare prices between meals served on board and in a restaurant at the airport.

These two factors (lower purchasing power and the need for passengers to buy meals) can encourage airports to increase concessions for catering at terminals where LCLH airlines operate, at the expense of commercial and duty-free concessions. This model is already being set up to accommodate low-cost short-haul carriers in most airports.

This decrease in the number of shops and duty-free stores could have an impact on the average shopping basket. To act against this, some airports offer themed restaurants or temporary restaurants depending on the seasons or regional events, offering higher prices than fast foods. Nevertheless, airports need to be cautious so the offers they provide do not cannibalize these extra-aeronautical earnings to the detriment of the LCLH airlines, whose business model is partly based on in-flight sales revenue.

The boarding process depends primarily on the configuration of the aircraft, the space available in the luggage compartments, and the passenger cabin baggage volume. These parameters will not be influenced solely by the duration of the flight or the nature of the airline, but also by the destination and the travel motive of passengers (leisure, business, etc.). It is therefore difficult at this stage to assess the operational impact that low-cost long-haul traffic could have on boarding. In some cases, the latter could be slowed down by a large volume of cabin luggage, but in other cases boarding could be similar to a conventional long-haul flight.

So far, low-cost long-haul flights remain largely operated by major hubs and European capitals. The arrival of a new fleet of single-aisle long-range aircrafts such as the Airbus A321 Neo Long Range, easier to load than large aircrafts, less expensive, and more fuel-efficient, could restructure the model for intercontinental flights in the next few years. In this change of model for low-cost carriers, airports have a strong card to play to facilitate connections for passengers, and thus be able to offer them services similar to London Gatwick or Milan airports that offer dedicated flows for self-connecting LCLH passengers, but also insurance services for missed connection. To achieve this, adapting their infrastructure will in many cases be necessary.

Sources

[1] Traditional long-haul serving NYC from Paris during the summer of 2018: Air France, Delta Airlines, United Airlines, and American Airlines.

Low-Cost Long-haul serving NYC from Paris during the summer of 2018: XL Airways, The Company, French bee, Norwegian, Level, Air Wow, Primera Air

[2] Cohor - Association pour la coordination des horaires

[3] Les Echos

[4] Paris Airport website, map of Terminal 3 - Paris Charles de Gaulle (departure hall)

[5] Paris Aéroport 2017 Annual Report

[6] Paris Airport website, terminal plan - Paris Charles de Gaulle

[7] Cohor - Association pour la coordination des horaires

[8] Site internet de Gatwick Airport, Gatwickconnects.

[10] Reference Document and Financial Report 2017 of Paris Aéroport.

[11] Sia Partners article : « Low-cost long-courrier : quelles innovations pour concurrencer les compagnies traditionnelles ? »