Urban Air Mobility Observatory (UAM)

Air freight is a key enabler of cross border trade which becomes especially critical for express deliveries, long-distance and efficient transportation of sensitive and critical goods.

It has suffered from decades of no growth but is now back on track with some positive forces supporting its growth: strong export orders, a booming e-commerce relying on express delivery, and an expected high-value specialized cargo.

Digitization is seen as a key lever for the development of new innovative services and solutions which will drive efficiency in the air cargo ecosystem and deliver incremental value to the end customers.

However, while road freight R&D works on autonomous cars development and rail freight has already triggered IoT [1] initiatives to develop use cases around predictive maintenance, geolocation, air freight appears to embrace more slowly digitization. While some major initiatives have been launched such as e-freight and digital cargo, digitization remains marginal.

This insight is based on a panorama of initiatives launched in air cargo by major airline companies and traditional air transportation institutions including IATA. It will therefore mainly highlight initiatives from the transportation side of the value chain.

The air cargo ecosystem is complex with many stakeholders involved along the value chain: shippers, carriers, customs, freight forwarders, integrators, airlines and end customer to only name a few.

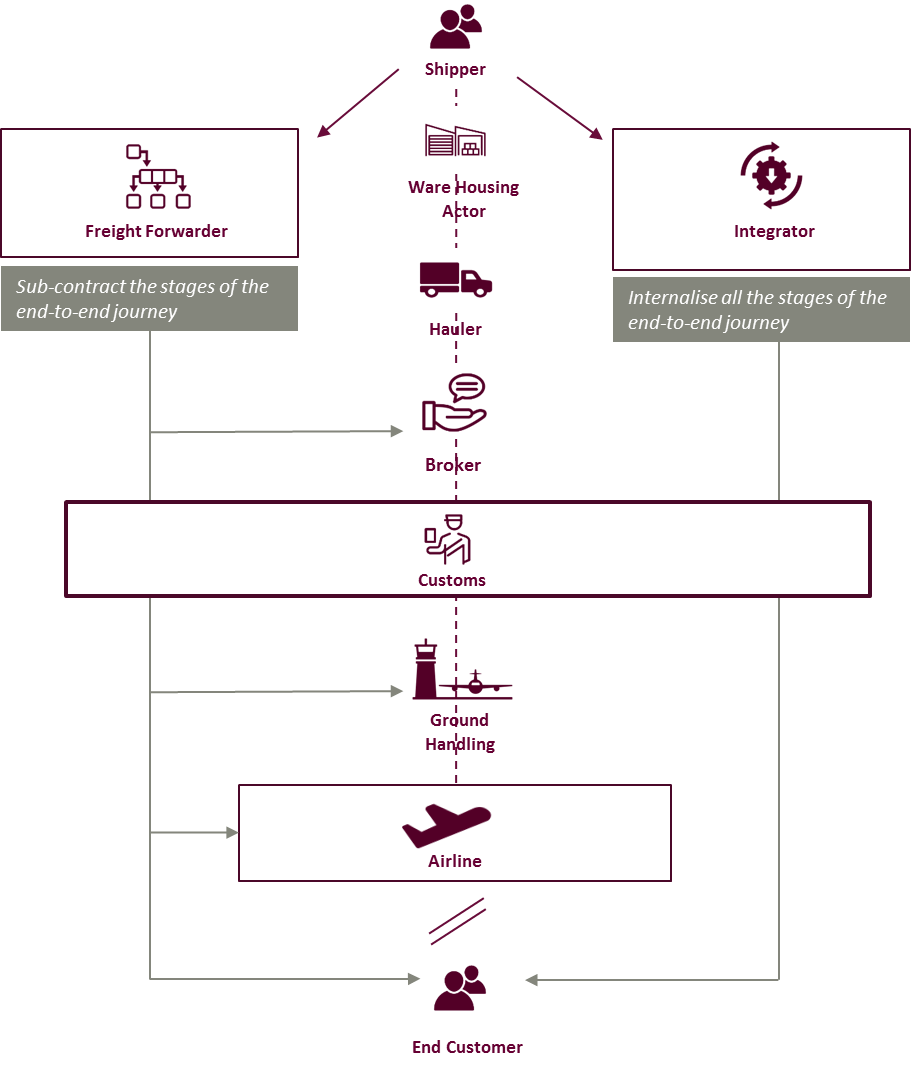

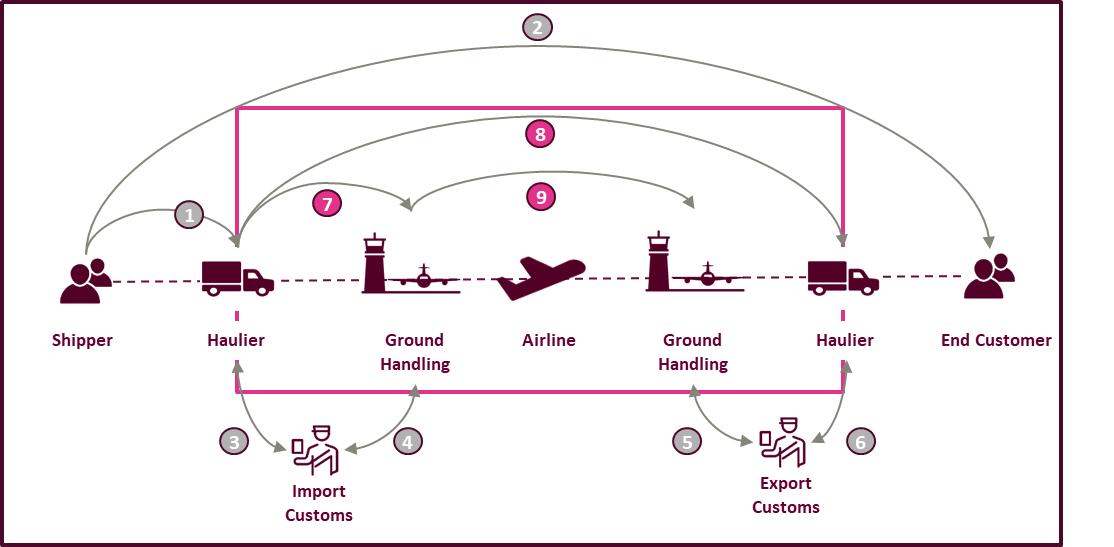

Two models are currently ruling the air cargo industry: the freight forwarding model and the integrated freight model [2]. The shipper will whether commission a freight forwarder that will sub-contract all the stages of the end-to-end journey or an integrator that will internalize all these stages by owning the assets to do so.

The integrator will then arrange the storage and the collection of the cargo, the surface transport to the airport, the changeover by custom borders, the air leg and the delivery to the final destination.

For the freight forwarding model, each stage of the journey will be under the responsibility of the sub-contracted actor. For the shipment transportation to the airport and then to the foreign destination, a hauler (in charge of the ground transportation), a ground-handling agent and an airline are involved. An insurance or customs broker can also participate in order to provide an expertise on specific subjects (see Figure 1 below).

Figure 1: Air cargo value chain

The air cargo industry has been slow to embrace digitization: whereas passenger airlines offer a diversity of booking channels, enable transparent product comparison and shopping experience and have all adopted electronic tickets, air freighters still predominantly rely on traditional channels such as call centers to promote rates which are not easily comparable with the competition and widely use numerous paper documents for their shipments. Nevertheless, digital is creating a new value proposition in every industry and customers’ rising expectations for a personalized, on demand and mobile service are not satisfied. Specifically, the limited offer pricing transparency, the lack of visibility over the localization and the status of goods transported is not up to speed with current customer expectations.

Furthermore, the industry still relies on paper-based processes to exchange shipment information along the complex supply chain. This lack of data integration and standardization is prone to poor data quality and error mistakes, limits the end-to-end visibility and anticipation along the shipment journey, thus exposing to any unexpected event and bringing inefficiencies to the supply chain.

Another challenge the industry faces is the difficulty to optimize cargo capacity utilization. This stems from structural overcapacity, jointly with dissymmetrical cargo flows and limited shipments predictability.

The industry is confronted to fierce competition from other transport modes, less expensive or perceived more environmental friendly, and is under continuous threat of new entrants. Big retailers such as Amazon, Alibaba and Walmart are well positioned to disrupt the traditional air cargo actors.

Major cargo airlines have addressed the customers’ needs for increasing freight offer transparency through the launch of online booking portals. This is the advent of a new direct booking channel: not only quotes become instantly available and updated in real time, but the booking and payment processes are significantly facilitated, and door to door service can even be offered, including the handling of customs formalities. Air freight services become available to B2C [3] customers who are able to send any kind of personal item in a convenient, quick and cost-effective manner through the possibility to look for the lowest available rate on a given time period and to specify the type of goods and specific treatment needed. This is namely the case via Lufthansa myAirCargo portal.

In parallel, online freight marketplaces develop, allowing shippers and transport providers to initiate business transactions. Startup Hangar A provides shippers on US domestic market with dynamic intelligent routing and quotes, based on airport origin and destination, shipment type, dimensions and weight, related ULD [4] options, as well as specific negotiated rates. Similar to online travel agencies like Kayak and Expedia, these new digital platforms allow a clear offer comparison between the providers who have shared availability and rates. Other platforms like Fleet or Cargobase simplify the freight forwarders’ selection process as shippers can submit online their shipment details and receive bids from freight forwarders which become more easily comparable than through the traditional process requiring separate calls to various freight forwarders. Even if at their early stage with limited geographical rich and partial transport value chain coverage, these internet portals are seen as disruptors for traditional “bricks and mortar” freight forwarders. However, these platforms are still far from questioning the traditional role of freight forwarders. Booking facilitation and rate quoting are certainly an important added value for the supply chains; however, customs clearance and documentation, temporary warehousing, final mile delivery and much more services emphasizes the pillar role of freight forwarders within the value chain.

Figure 2: New digital freight landscape

With numerous paper documents along the value chain sometimes leading to inaccuracies, losses and misunderstandings at transcription, the International Air Transport Association (IATA) initiated two major projects to streamline the communication process along the air cargo journey: e-Air Waybill (e-AWB) and e-Freight.

An air waybill is the contract of carriage between the shipper (direct or freight forwarder) and the airline, with one copy that will always be attached to the consignment. E-AWB project aims at electronically standardizing air waybills. The expected benefits are many and encompass an increased accuracy, quality and reliability of data exchanges across airlines and shippers/forwarders, and reduced processing costs. This project is also expected to reduce cargo handling delays, ease security compliance and improve customer service. IATA is closely monitoring the e-AWB monthly performance of airports, airline companies and freight forwarders through e-AWB penetration with a target of 68% for December 2018 [5].

E-freight project has a broader aim as it consists in the development and implementation of end-to-end paperless transportation processes for air cargo, involving all the stakeholders across the value chain. This project is made possible through a regulatory framework, modern electronic messages and high quality of data. E-freight was initially kicked off in 2006 but a roadmap for paperless air cargo was created in 2013 to accelerate the industry’s adoption. More specifically, e-freight aims at removing customs, transport, commercial and special cargo documents.

Figure 3: Paperless Transportation (e-Freight and e-AWB)

To support e-Freight and e-AWB, IATA has developed Cargo-XML messaging standards that enable electronic communication between airlines and other stakeholders of the value chain. There are now 12 messaging standards covering 20 documents.

New technologies are meant to be a game changer to the air cargo industry, and IoT and advanced analytics are the technologies making their way up through the industry. IoT can enable to speed up cargo handling, improve accuracy, and help to locate any missing items facing the issue of lost, missing or underutilized ULD. Other use cases encompass predictive maintenance, routing and asset management optimization, or temperature monitoring for sensitive healthcare goods and animals.

Some airlines have already launched initiatives in these areas. Air Canada is for instance equipping cargo shipments with RFID [6] sensors (temperature and humidity sensors) in order to improve customer service but also help ensure ongoing compliance as regulations change. Delta Air Lines has developed a pet-tracking service. IATA, on the other hand, is pushing for air cargo to be modernized by promoting the Interactive Cargo project, part of StB program [7]. Interactive Cargo aims at going further into new technologies in order to track and monitor cargo. This project promotes the use of intelligent systems that are able to self-monitor, send real-time alerts, respond to deviation to meet customers' expectations and report on the cargo journey to allow data-driven improvements.

Although the number of initiatives is rising up and the opportunities are countless, their actual deployment is still limited.

Cargo capacity corresponds to the saleable space the airline can offer for shippers to transport their goods, and therefore is directly linked to potential freight revenue. However, available capacity prediction is much more complex than in the passenger segment for various reasons: demand is more volatile; belly capacity is not fixed but depends on runways, weather, passenger cabin occupancy, fuel carried; capacity is multi-dimensional based on volume, weight, configuration of containers; multiple routing options are available as long as the shipment arrives at destination; shipment flows are dissymmetric; booking period is very short with most booking outside of long term contracts being made one week prior to departure, show up rates are high, etc.

If such complexity can be handled manually, optimal decisions need the support of strong data analysis solutions. Advanced analytics provide capacity availability and demand forecast based on past behaviors and latest trends and derive a market price segmentation as well as an associated bid price which corresponds to the minimum acceptable price for a given shipment density.

Some cargo airlines have already implemented business intelligence solutions like revenue management systems CargoRM or Wiremind SkyPallet to optimize their cargo capacity utilization and revenues, however they lag behind passenger services processes deployed related to seats occupation optimization.

Faced with the need to reinvent itself, the air cargo has gradually adopted digital opportunities with different levels of maturity. While there is a progressive adoption of IATA e-AWB standard, business intelligence tools for revenue and capacity utilization optimization, booking portals for direct link with the end customer, IoT and Big data remain of marginal use and struggle to develop.

The potential behind these digital opportunities can be translated into new services with high added value for the customer, operational excellence, incremental revenues and improved links with business partners. Therefore, the digital roadmap will highly differ depending on the stakeholder positioning in the value chain and their strategy.

All in all, no matter their specific ambitions, all air cargo stakeholders should follow a common goal: reaffirm the competitiveness of air transport compared to alternative modes of freight transportation, all of which are more advanced in their digital transformation.

Figure 4: Overview of air cargo digital opportunities

[1] Internet Of Things

[2] The air freight end-to-end journey, Department for Transport, 2009

[3] B2C: Business to consumer; businesses selling products and/or services to end consumers

[4] Unit Load Device: a pallet or container used to load aircraft

[5] e-AWB international monthly report, IATA, 2018

[6] Radio Frequency Identification: technology using radio frequency electromagnetic fields to identify objects carrying tags approaching a reader

[7] Simplifying the Business program: IATA initiative for aviation industry business practices and processes transformation