Urban Air Mobility Observatory (UAM)

Understanding and interpreting the results of complex models is essential to avoid a black-box effect. Sia Partners supports clients in the development of interpretive methods and adapted tools.

Given the boom in the volume of available data, insurers must innovate and implement new methods of data processing. This improves risk assessment and quantification while allowing market players to adapt their product offerings to customers' increasing expectations.

However, if these methods allow an improvement in predictive performance, this is generally obtained at the expense of interpretability. With this in mind, the Protection & Social Care team decided to develop studies responding to the need for transparency on the choice and use of complex algorithms.

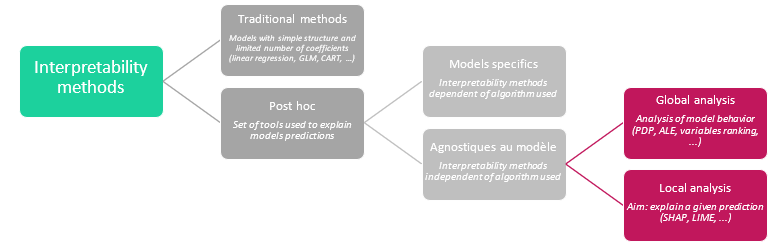

Thus, to provide solutions adapted to our customers, Sia Partners offers to leverage the tools offered by Machine Learning, by identifying new risk factors, integrating external data, or even limiting the number of pricing variables to simplify the processes. There are many interpretability solutions that must be selected according to the underlying models:

The tools used are mainly dependent on the business objective, the client and their business constraints. Thus, the solutions retained and the tools developed must be adapted to the problems encountered by our customers.

It is now important for insurers to analyze the risks and opportunities of the new digital context to define an overall strategy, which is consistent with changes in the sector and the needs of society. This improvement in risk assessment and quantification capacities is founded on several pillars:

• Customer experience: products and services customization, customer segmentation, identification of expectations, etc.

• Business processes: reducing processing times for customer requests, automation of repetitive tasks with low added value, etc.

• Optimizing the pricing process: analysis of policyholder behavior, use of external data (open-data, data-capture), the study of customer value, etc.

• Prevention: quantification/optimization of a prevention plan, in particular according to behavioral analyses, prioritization/calibration of prevention needs, tec.

This way, our internal work makes it possible to enhance our services using methods similar to Artificial Intelligence to ensure perfect interpretability of the models developed for our clients.