Fortune 100 response to DE&I pressures

In a perpetually changing society, the concept of tailored products is a fundamental step. Sia Partners supports clients in this development and leverages the benefits of the Consulting 4.0 ecosystem for them.

In today's competitive environment, pricing strategy remains a key component in the viability and profitability of Health and Protection insurance products. Sia Partners supports clients in the different phases of the pricing process:

Sia Partners' expertise covers all of the actuarial pricing models on the market and offers alternative approaches to meet the specific needs of providers, in light of current trends. The selection of models is an essential step because they must adapt to the internal environment of the firm but also be consistent with objectives. Several models are used today:

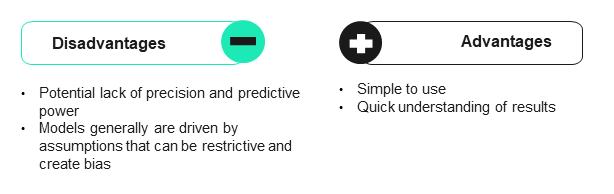

These types of models are easily interpretable. These models have a simple structure and a limited number of coefficients (linear regression, GLM, CART, ...).

However, their simplicity of use comes at the expense of their performance and can show their limits depending on the objectives.

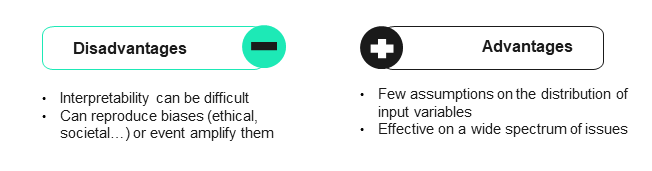

These models, often called black boxes, are becoming more and more prominent because of their efficiency, in particular their predictive power. However, they also have disadvantages because they can be difficult to understand or use.

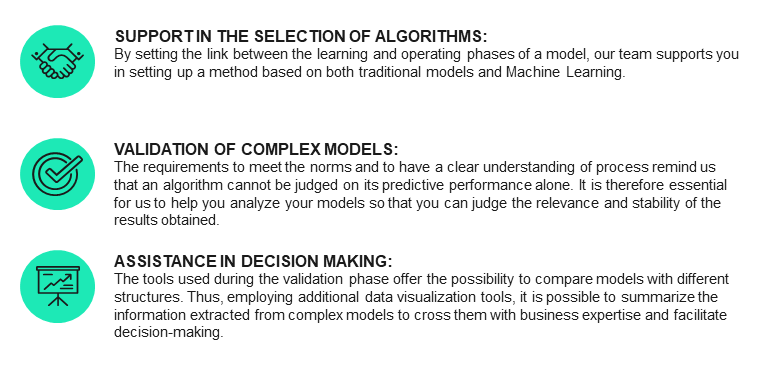

Sia Partners provides support to clients in the choice of models and their implementation. Our firm can also help with the development of alternative methods using traditional models which are enhanced by additional analyses (based on machine learning) to optimize the modeling performance while maintaining the following criteria:

• Representative and relevant: refine modeling and understanding of portfolio risk.

• Transparent and auditable: understand and explain the modeled risk, how the model works, and the results obtained.

• Adaptable: adapt the model to economic, regulatory, and technological developments that have an impact on the behavior of policyholders and the modeled liabilities.

Pricing needs to adapt to the internal and external environment of the insurance company, and in this time of constant change, many players have initiated price optimization projects. Here is our three-step approach: