Revolutionizing Asset Management Operations: The…

When it comes to distribution, insurers choose various strategies to stay ahead from the competition.

Three of the major concerns as part of the distribution challenges are:

What is your role at Sun Life?

Raised in Canada, I relocated to Hong Kong 20 years ago. I spent 30 years from an actuarial background to Business, between GI2 and Life. I joined Sun Life Hong Kong3 5 years ago, as Chief Agency Officer, got promoted to Chief Distribution Officer, and took over Marketing & Digital.

What are Sun Life’s distribution specificities in APAC?

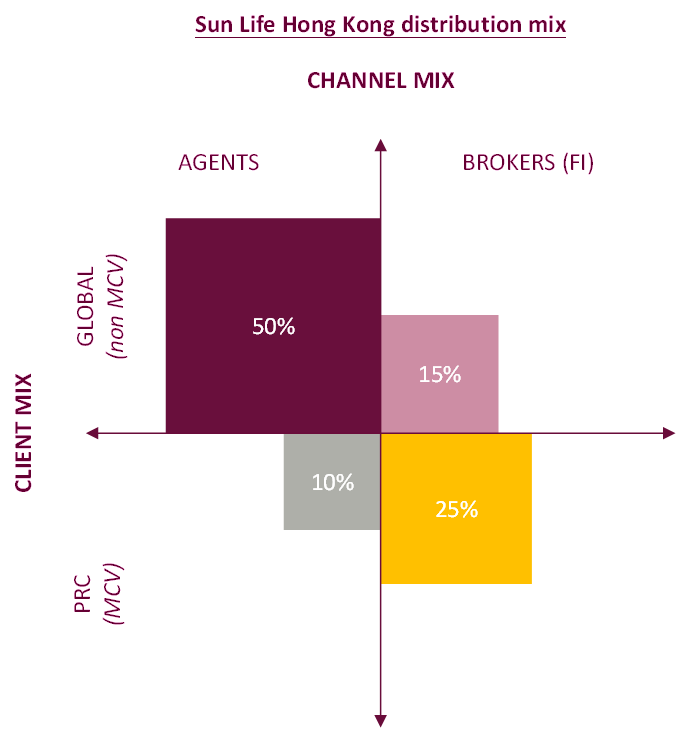

Sun Life’s two major channels are agents and brokers. Our breakdown of clients is rather Global than Mainland Chinese-centric (MCV), as they look for salesforces with a network in China (PRC), which Sun Life is still building. However, we have experienced a strong growth since 2012, where our MCV share approached 20% for brokers, and 2.5% for agencies.

What triggers drive your distribution strategy?

Three main drivers for Sun Life:

1. When I joined, Sun Life salesforce stagnated around 1000 agencies. To go up, we focused on FIXING THE FUNDAMENTALS. Over the past 5 years, we doubled our revenues, sales force and efficiency. We are now ready to take it to the next level, from basics to innovation.

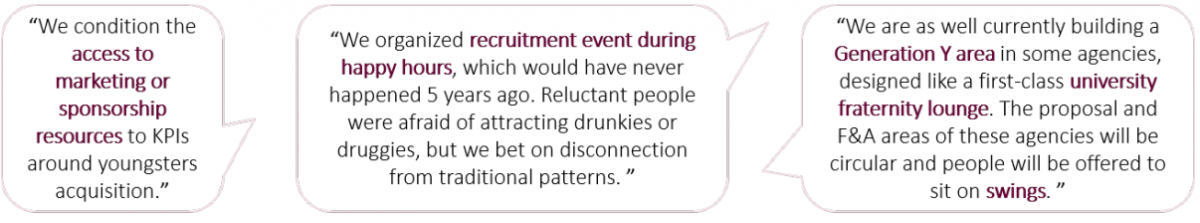

2. We initiated out-of-the-box campaigns for our agents to not only RECRUIT YOUNGER ADVISORS, but also YOUNGER CLIENTS. To drive behaviors, you have to either incentivize, reward or punish. We chose all three to foster the change. To us who are rather conservative, this will be a “wow” achievement.

3. We use our strong MPF scheme as a recruitment tool (also a reason why we are not skewed towards MCV). As 80% of our agents have the MPF license and 20% of their sales comes from pensions, I want to make even bigger THIS PRODUCT DIFFERENTIATION.

What is the role of Distribution in Customer Experience improvement?

We do not use “customer” anymore, but “clients”. Every time the word pops out, 5 dollars in a box! A customer is a consumer, when a client is a person with whom we create a bonding beyond professional service.

We observed that, even though regulators act to protect clients, insurers sometimes deploy programs just because they have to. But miscellaneous forms may have the opposite effect and confusion may arise. I feel that Sun Life can make a difference by making things simple.

How does Sun Life’s cope with Distributor Experience?

We tailor our support to distributors:

1. As we cannot induce BROKERS to sell, we set up a support team to go beyond pure sales, providing Marketing, training and Digital tools. We emphasize reactivity with a turn-around-time below T+2. We treat brokers as clients, to understand their needs to grow.

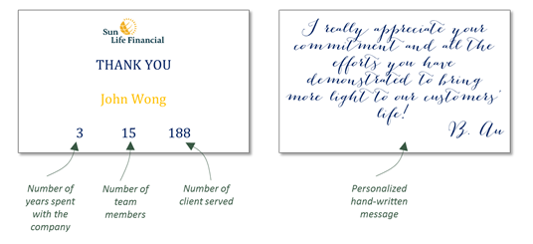

2. Some insurers consider AGENTS as business partners, I don’t. To me they are Sun Life. However, I noticed 5 years ago a pride scarcity, due to a lack of brand recognition after a merger4 and to the painful application of GN15. I dedicated myself to restoring pride and passion. I swore to create Wow effects each time I meet with agents. How? I started with thank you notes, propelling care as a key value.

We also worked on creating connections with fruit days, home-made soup sharing or themed afternoon teas. To make people bring ideas, you have to sit down, think, and factor in local cultures. Our actions made noise, and we are now better able to attract talents. Let’s sustain this momentum.

Insurers focus increasingly on cross and up-sell. Any opportunity for Sun Life?

As it is not easy to foster from a company standpoint, we rely on individuals. We ease our agents’ life by providing scripts and target recommendations. E.g., MPF is our strength, but we face data privacy issues. We thus train agents on building relationships beyond pension, to the signature of explicit marketing consent forms. Our focus is Client For Life, where ease of doing business, frequent client contact and proactive problem resolution is key to better cross and up sell.

Given the tech and societal changes in Asia, how will Sun Life adapt its distribution mix?

Digital is the buzz word. Sun Life did not have a Digital roadmap until we decided 1.5 year ago to invest. We started by defining what Digital means to us in terms of platforms and marketing. As a first result, we will release our new website by end 2017. Our shift is only starting, the journey will be dense.

How do you engage distributors?

We set up the SEED programme5 to motivate our high performing District Directors (50 people teams) to become Agency Director (100 people) within 3 years instead of 9. This 360 programme provides support to build a persona to attract youngsters and uplift professional competency with 1-to-1 coaching, with social medial marketing and recruitment networking support. To join SEED, we imposed KPIs such as having at least 15% MDRT6 producers, 15% of Elite producers7, and 15% of GenY8 per team. The latter will be their 40 in 10 year time and no agency force will be resilient without them.

Will an agency force be sustainable? My answer is yes, for the next 8 to 10 years. In Hong Kong, Digital is accessible anytime, but agents too! Too convenient, in a sense. Why go Digital? Besides, the need for empathy remains significant in Life. Eventually, we will turn Digital within a decade, but pushed by other countries.

And finally… what’s next?

Our priority for 2017 is to build a Digital platform as we stand behind, with the advantage of having no legacy and a positive mindset. We will next scale up our agency salesforce to 3000 people, to fully leverage our investments in Digital and Marketing.

1 Cross-sell refers to selling additional products or services to clients, when up-sell refers to selling more expensive products or services.

2 GI = General Insurance

3 Sun Life operates in China through a joint-venture, with China Everbright Bank, however, under a different management, regulation and share ownership.

4 Sun Life Financial (Hong Kong) Ltd acquired CMG Asia in 2005, later rebranded into Sun Life Hong Kong Ltd.

5 SEED = Sun Elite Executive Director

6 Million Dollar Round Table, an American trade association supporting Insurance brokers and financial advisors

7 Worldwide, only 2 to 3% of people are labelled MDRT in sales organizations. In Hong Kong last year, this rate reached over 10%, thanks to the PRC business sales volumes.

8 Born in 1990 and after